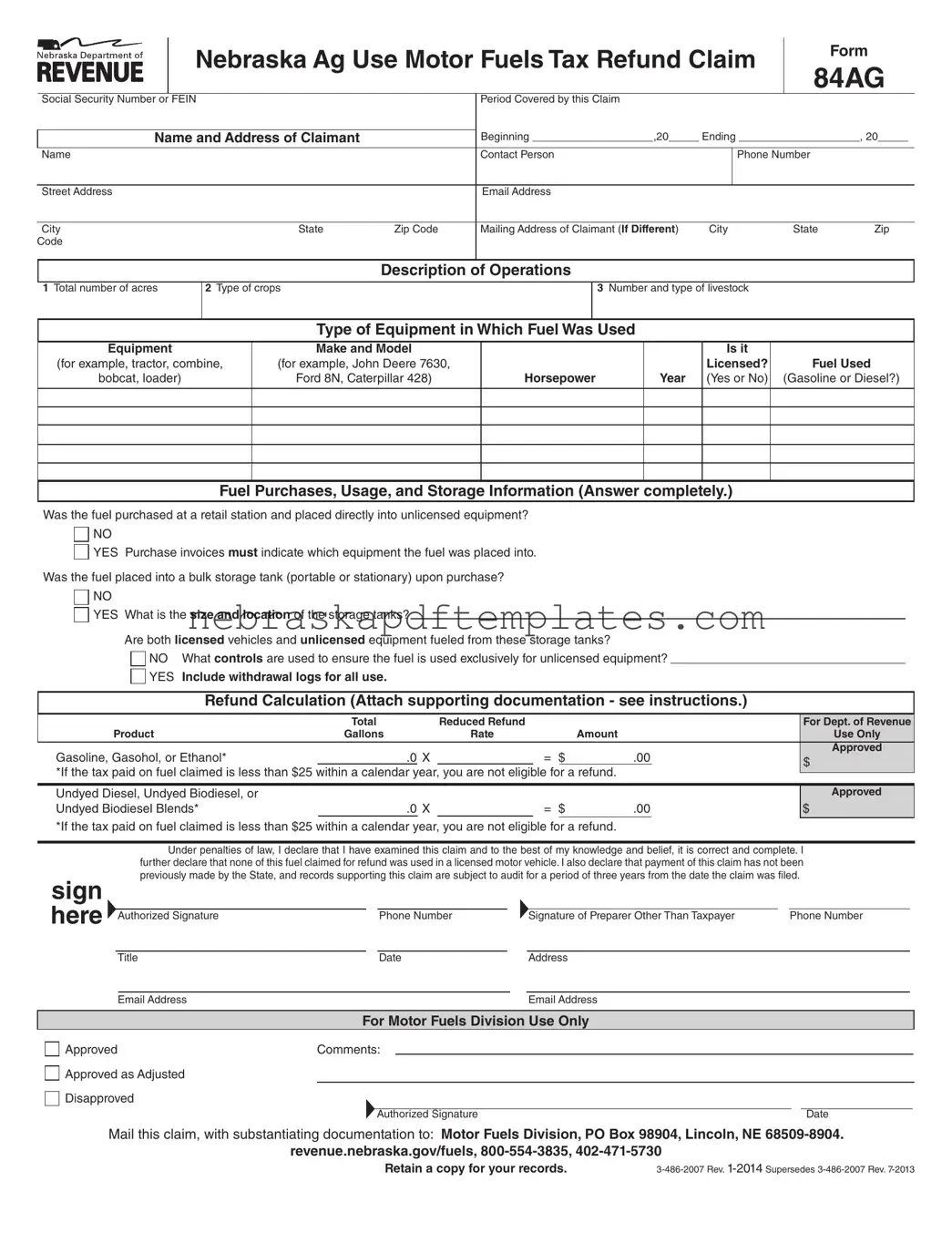

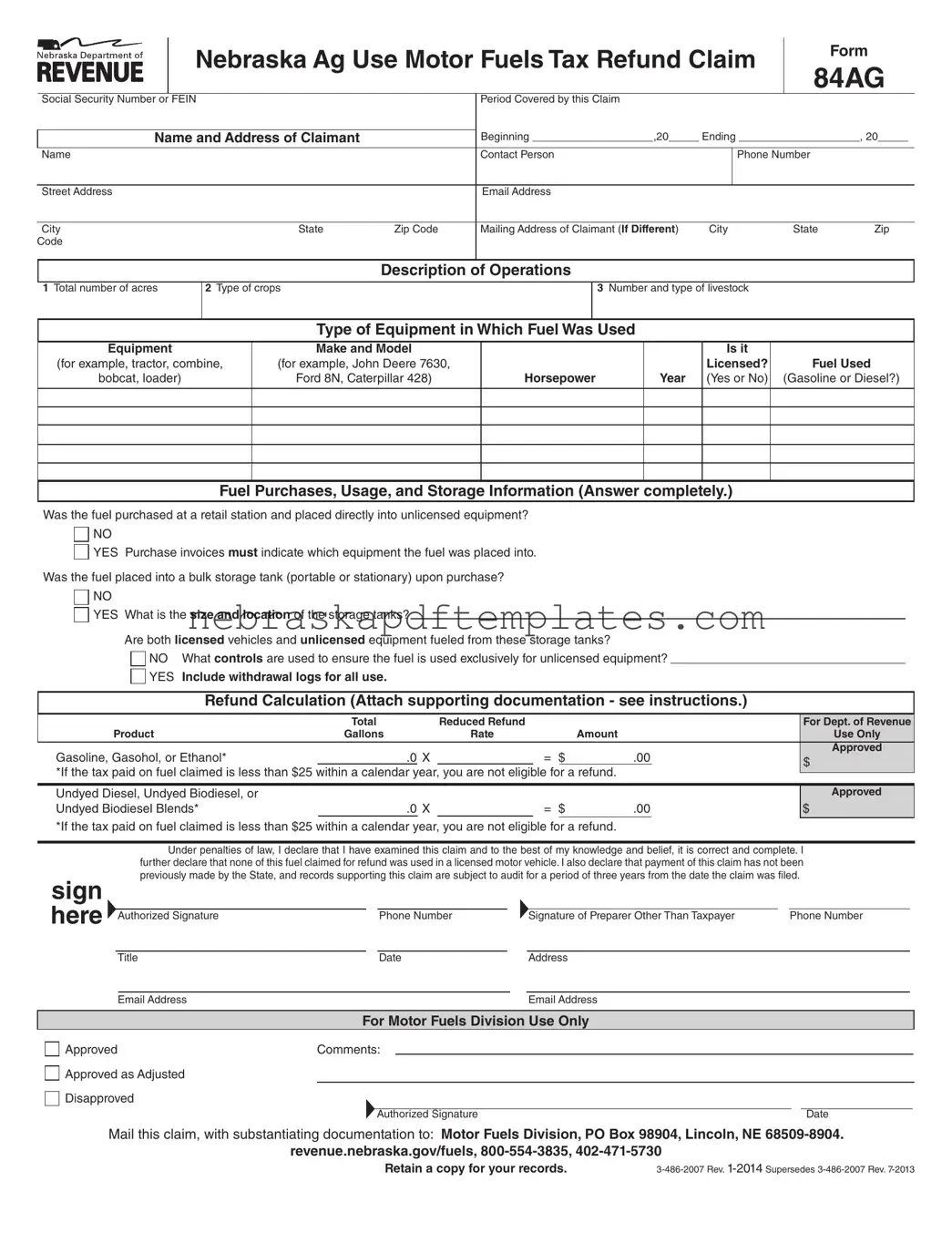

Blank 84Ag Nebraska PDF Template

The Nebraska Ag Use Motor Fuels Tax Refund Claim Form 84AG is designed for individuals seeking a refund on motor fuels tax paid for fuel used in unlicensed farming or ranching equipment. This form requires detailed information about fuel purchases, usage, and the specific operations conducted. If you believe you qualify, consider filling out the form by clicking the button below.

Access Editor Here

Blank 84Ag Nebraska PDF Template

Access Editor Here

Finish your form now

Finalize 84Ag Nebraska online — edit, save, and download effortlessly.

Access Editor Here

or

➤ 84Ag Nebraska