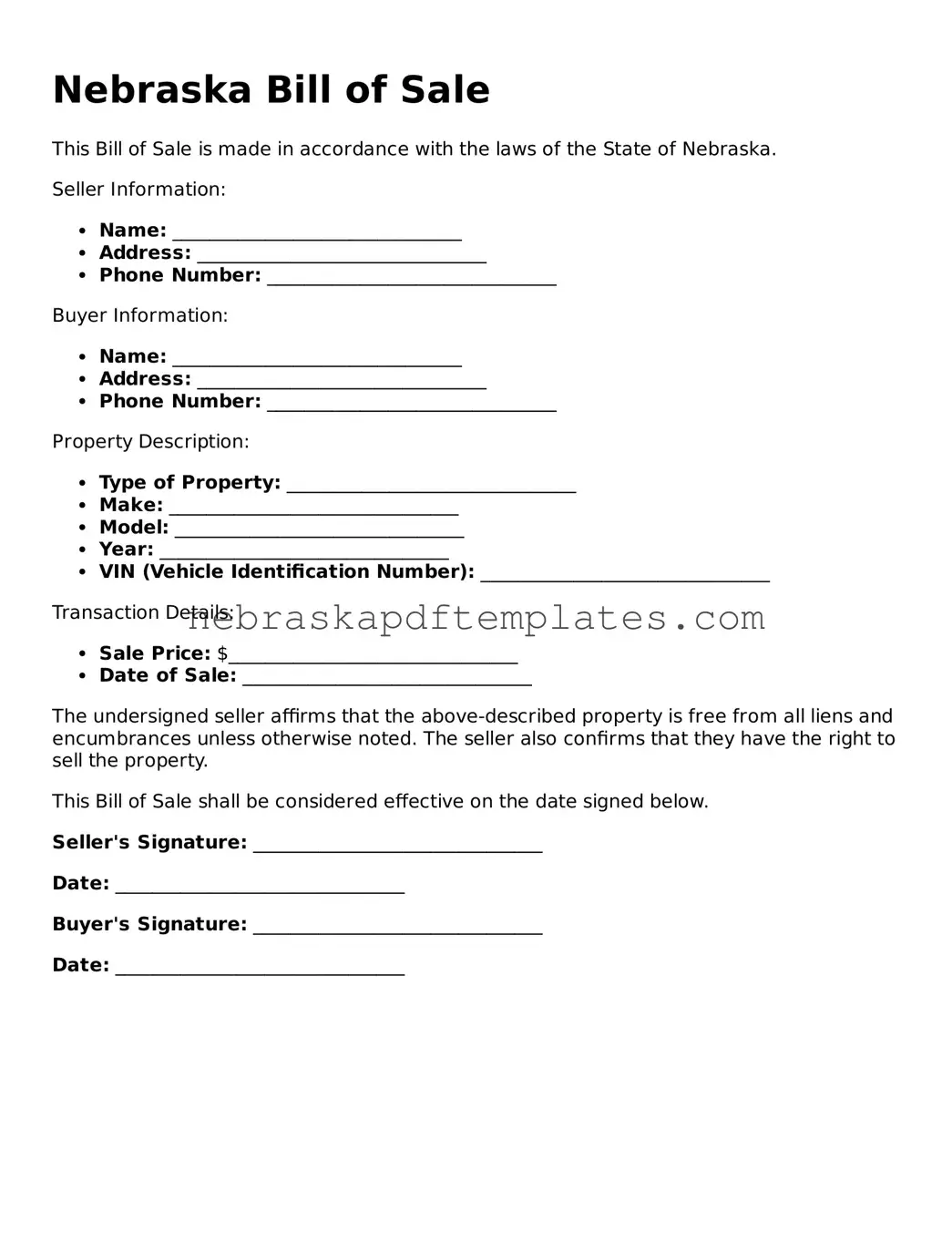

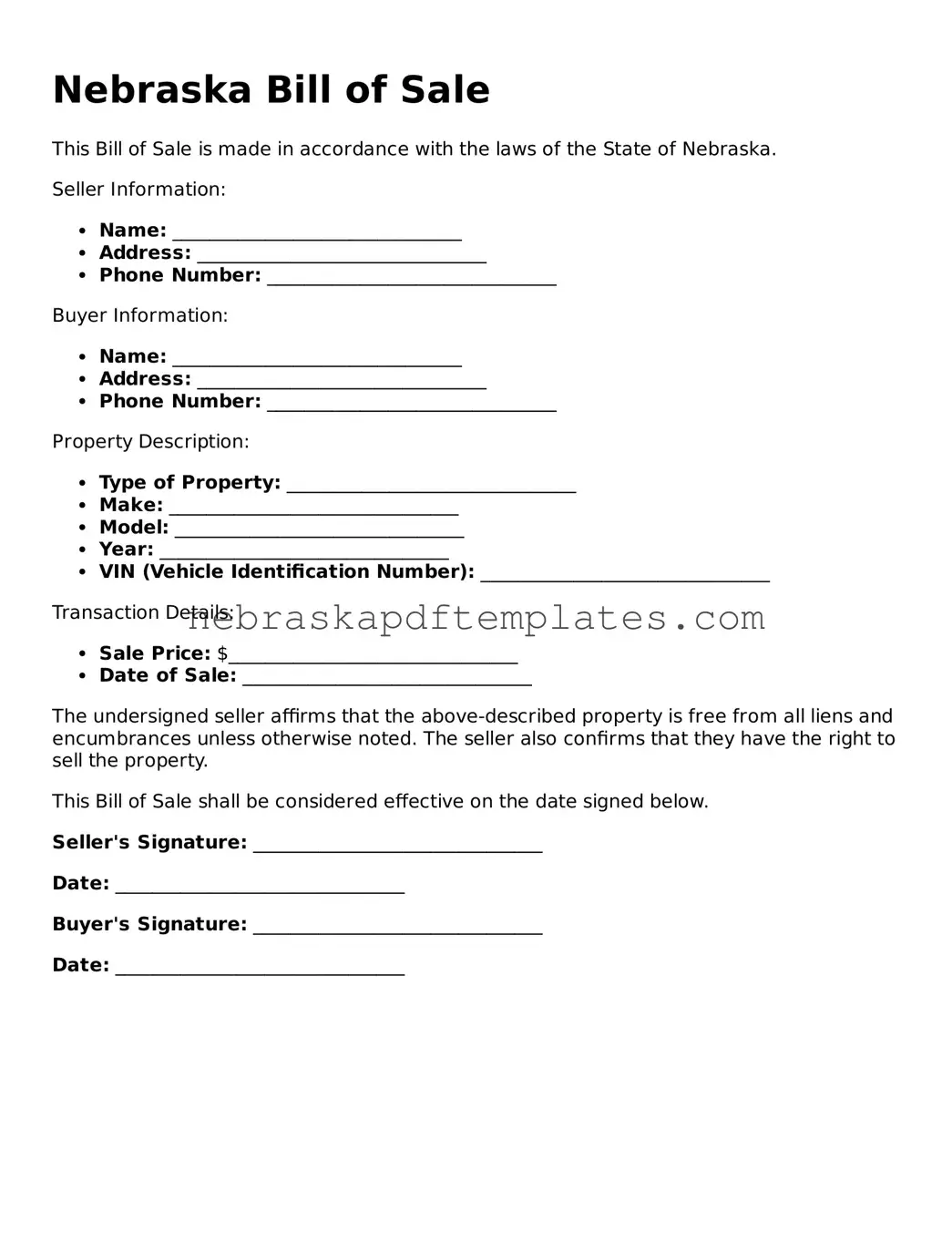

A Nebraska Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. It serves as proof of the transaction and includes details about the item being sold, the buyer, and the seller. This form is particularly important for items like vehicles, boats, and other significant assets.

When do I need a Bill of Sale in Nebraska?

You should use a Bill of Sale whenever you sell or purchase personal property. While it is not always legally required for every transaction, having one can protect both the buyer and the seller by providing a clear record of the sale. For vehicles, a Bill of Sale is often required for registration purposes.

A typical Nebraska Bill of Sale includes the following information:

-

The names and addresses of the buyer and seller

-

A description of the item being sold, including its condition

-

The purchase price

-

The date of the transaction

-

Signatures of both parties

This information helps ensure that the document is complete and can be used effectively in case of any disputes.

Is a Bill of Sale required for vehicle transactions in Nebraska?

Yes, a Bill of Sale is required for vehicle transactions in Nebraska. It must be completed and signed by both the buyer and the seller. This document is necessary when registering the vehicle with the Nebraska Department of Motor Vehicles (DMV). It helps establish legal ownership and can be crucial if any issues arise regarding the vehicle's history.

Can I create my own Bill of Sale in Nebraska?

Absolutely! You can create your own Bill of Sale as long as it includes all the necessary information. Many templates are available online, which can help guide you in drafting a document that meets your needs. Just ensure that it includes all relevant details and is signed by both parties to be legally binding.

Do I need to have the Bill of Sale notarized?

In Nebraska, notarization is not a requirement for a Bill of Sale. However, having the document notarized can add an extra layer of authenticity and may be beneficial in case of disputes. It provides a witness to the signing, which can be helpful in legal situations.

How long should I keep a Bill of Sale?

It is advisable to keep a Bill of Sale for at least three to five years after the transaction. This timeframe allows you to have a record in case any issues arise regarding the sale or ownership of the item. For significant assets, such as vehicles or real estate, retaining the document for a longer period may be prudent.

What should I do if I lose my Bill of Sale?

If you lose your Bill of Sale, you can create a new one, but both parties must agree to the terms again. If the original sale involved a vehicle, you might also need to contact the DMV for guidance on how to proceed. They may have specific procedures for situations involving lost Bills of Sale, especially for vehicle registration.