A Nebraska Deed form is a legal document used to transfer ownership of real property from one party to another within the state of Nebraska. This form outlines the details of the transaction, including the names of the parties involved, a description of the property, and any conditions related to the transfer.

In Nebraska, several types of Deed forms are commonly used, including:

-

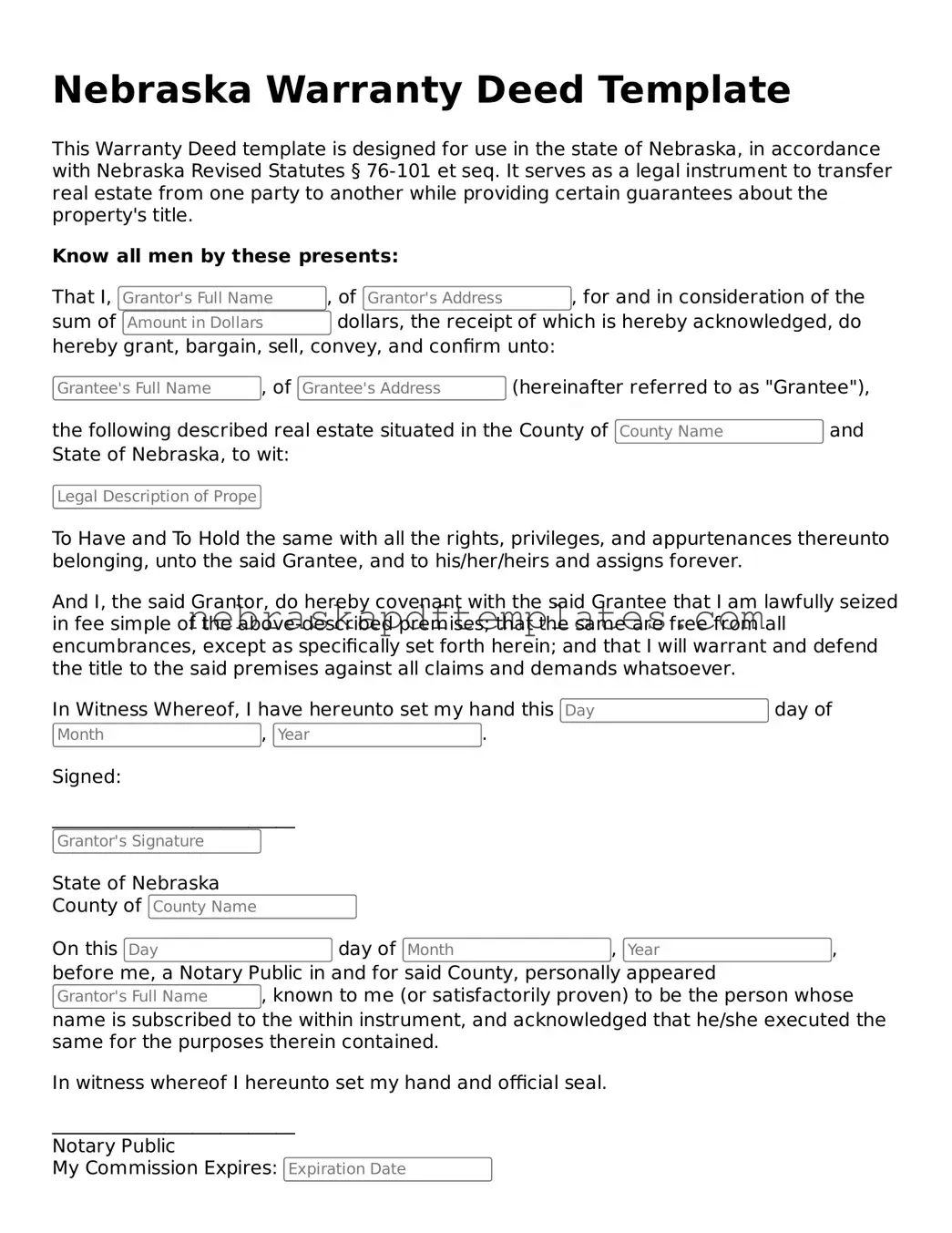

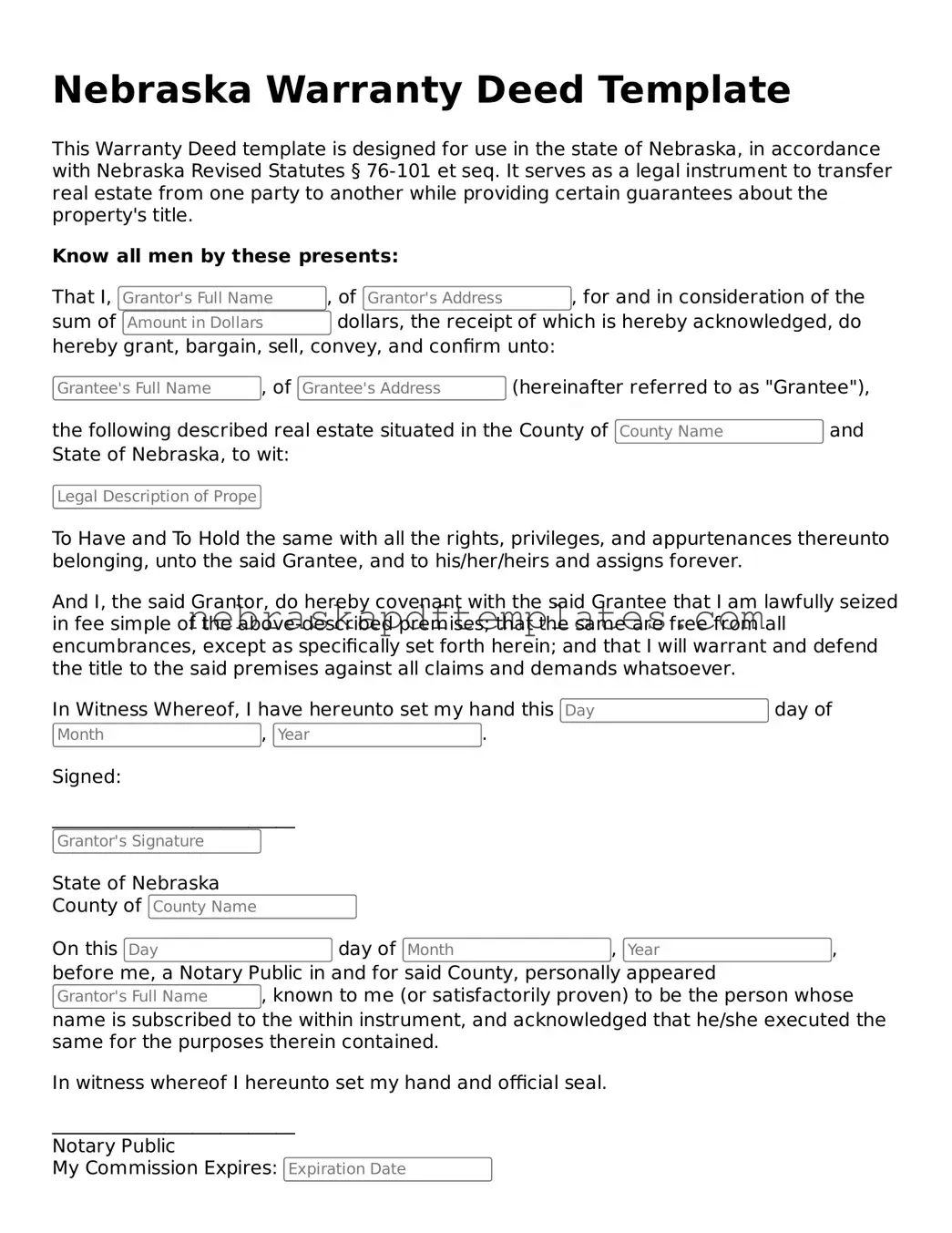

Warranty Deed:

Provides a guarantee that the grantor holds clear title to the property and has the right to sell it.

-

Quitclaim Deed:

Transfers any interest the grantor may have in the property without making any guarantees about the title.

-

Special Warranty Deed:

Similar to a warranty deed but only guarantees that the grantor has not encumbered the property during their ownership.

The Nebraska Deed form must be signed by the grantor, the individual or entity transferring the property. In some cases, the grantee, or the recipient of the property, may also need to sign. It is advisable to have the signatures notarized to ensure the document is legally binding.

Yes, while it is not strictly required for all types of deeds, notarization is highly recommended. A notarized deed can help prevent disputes regarding the authenticity of the signatures and the intentions of the parties involved.

Once completed and signed, the Nebraska Deed form must be filed with the appropriate county register of deeds. This filing serves to officially record the transfer of ownership and make it a matter of public record. There may be a filing fee associated with this process.

Are there any taxes associated with the transfer of property using a Nebraska Deed?

Yes, when property is transferred in Nebraska, a documentary stamp tax may apply. This tax is typically based on the sale price or the value of the property being transferred. It is important to consult with a tax professional or legal expert to understand the specific tax obligations related to your transaction.

Once a deed has been filed and recorded, it cannot be unilaterally revoked or changed. However, if both parties agree, they may execute a new deed to correct or alter the terms of the original transfer. Consulting with a legal professional is advisable to navigate this process.

To complete a Nebraska Deed form, the following information is typically required:

-

Names and addresses of the grantor and grantee.

-

A legal description of the property being transferred.

-

Consideration, or the amount paid for the property.

-

Date of the transaction.

Nebraska Deed forms can be obtained from various sources, including:

-

County offices, such as the register of deeds.

-

Legal stationery stores.

-

Online legal document services.

It is essential to ensure that the form you obtain complies with Nebraska state laws.

If you have additional questions or need further clarification, consider reaching out to a local attorney who specializes in real estate law. They can provide guidance tailored to your specific situation and help ensure that the property transfer process goes smoothly.