Attorney-Verified General Power of Attorney Document for Nebraska

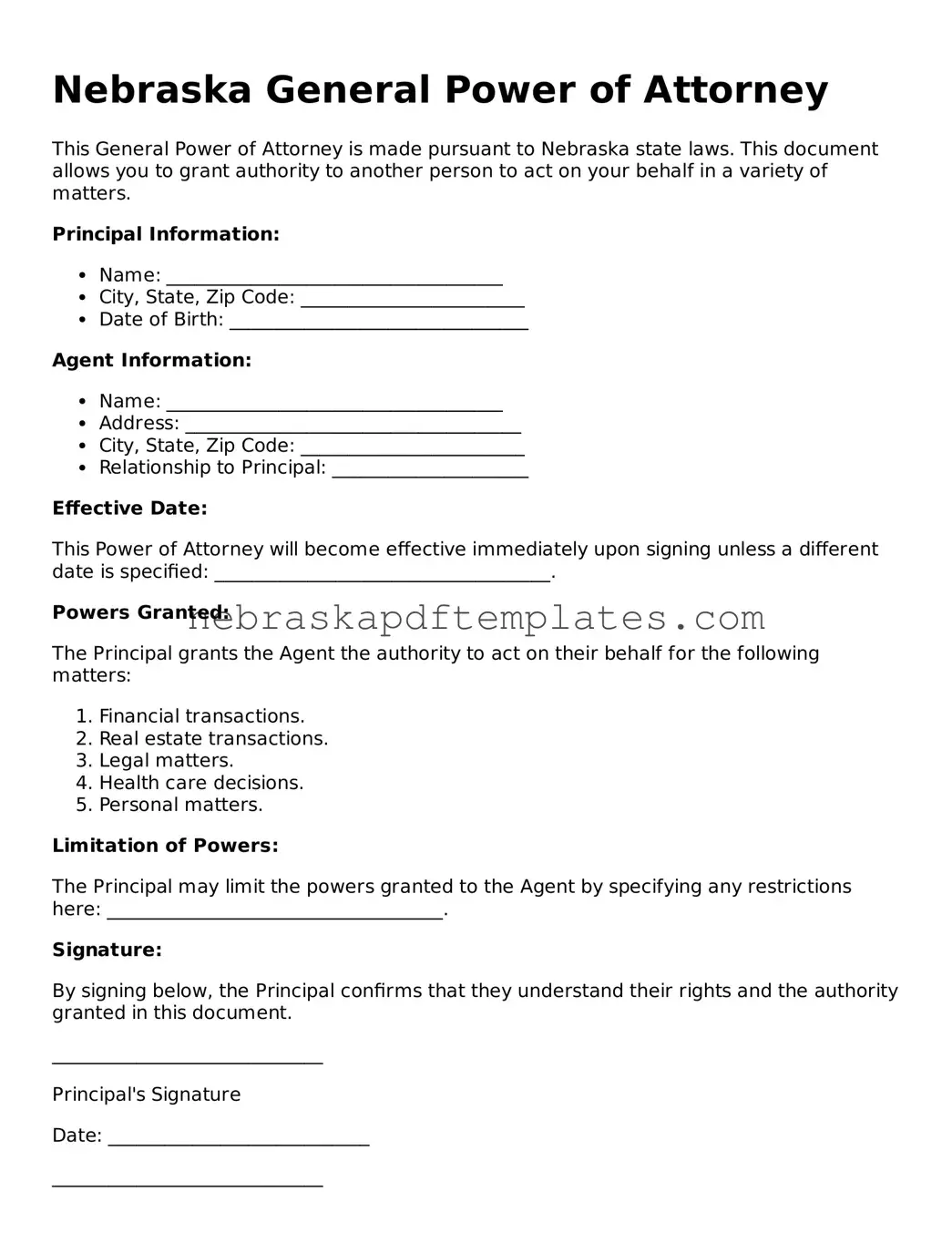

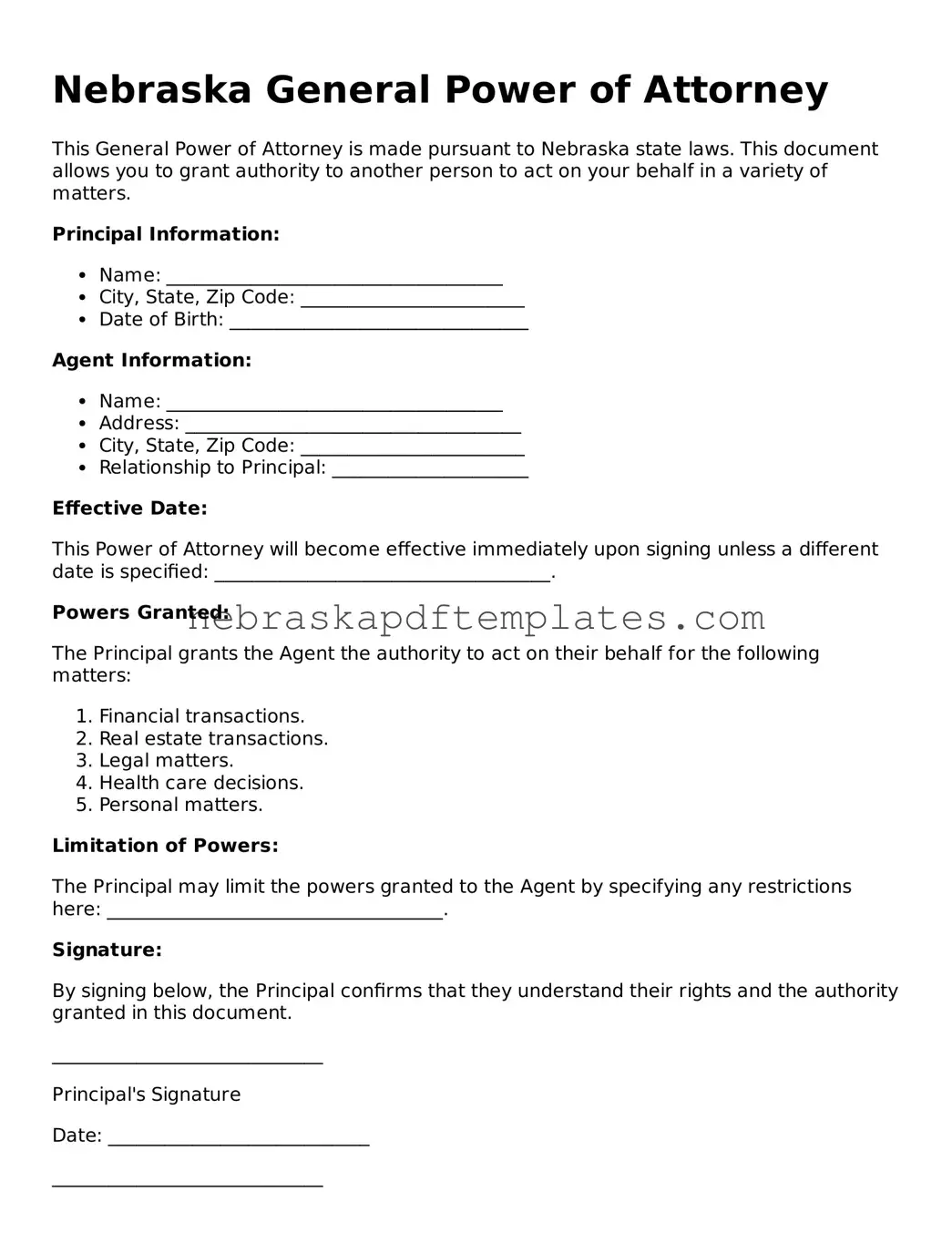

A Nebraska General Power of Attorney form is a legal document that grants an individual the authority to act on behalf of another person in a variety of financial and legal matters. This form can be essential for ensuring that someone you trust can manage your affairs when you are unable to do so yourself. To take the next step in securing your interests, consider filling out the form by clicking the button below.

Access Editor Here

Attorney-Verified General Power of Attorney Document for Nebraska

Access Editor Here

Finish your form now

Finalize General Power of Attorney online — edit, save, and download effortlessly.

Access Editor Here

or

➤ General Power of Attorney