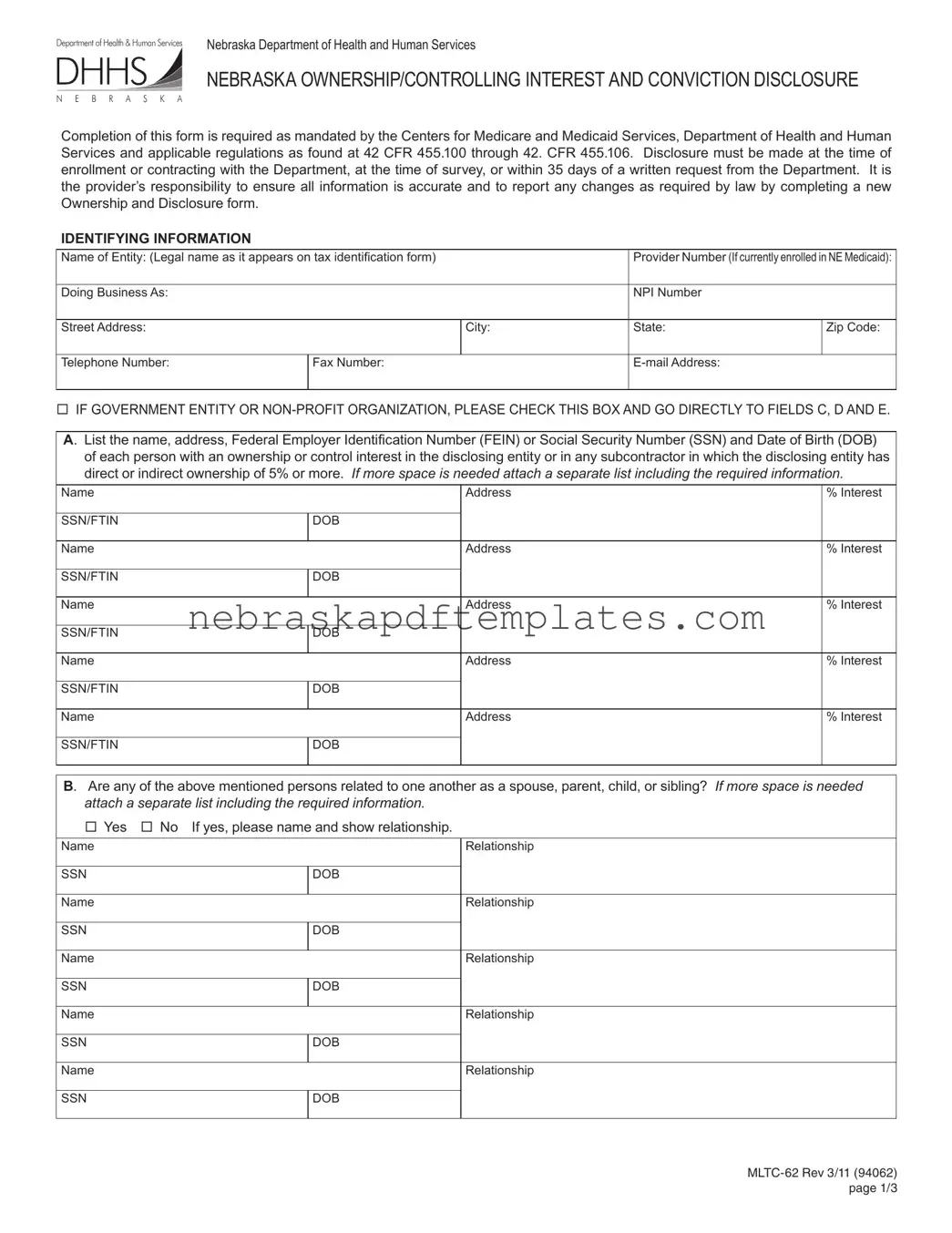

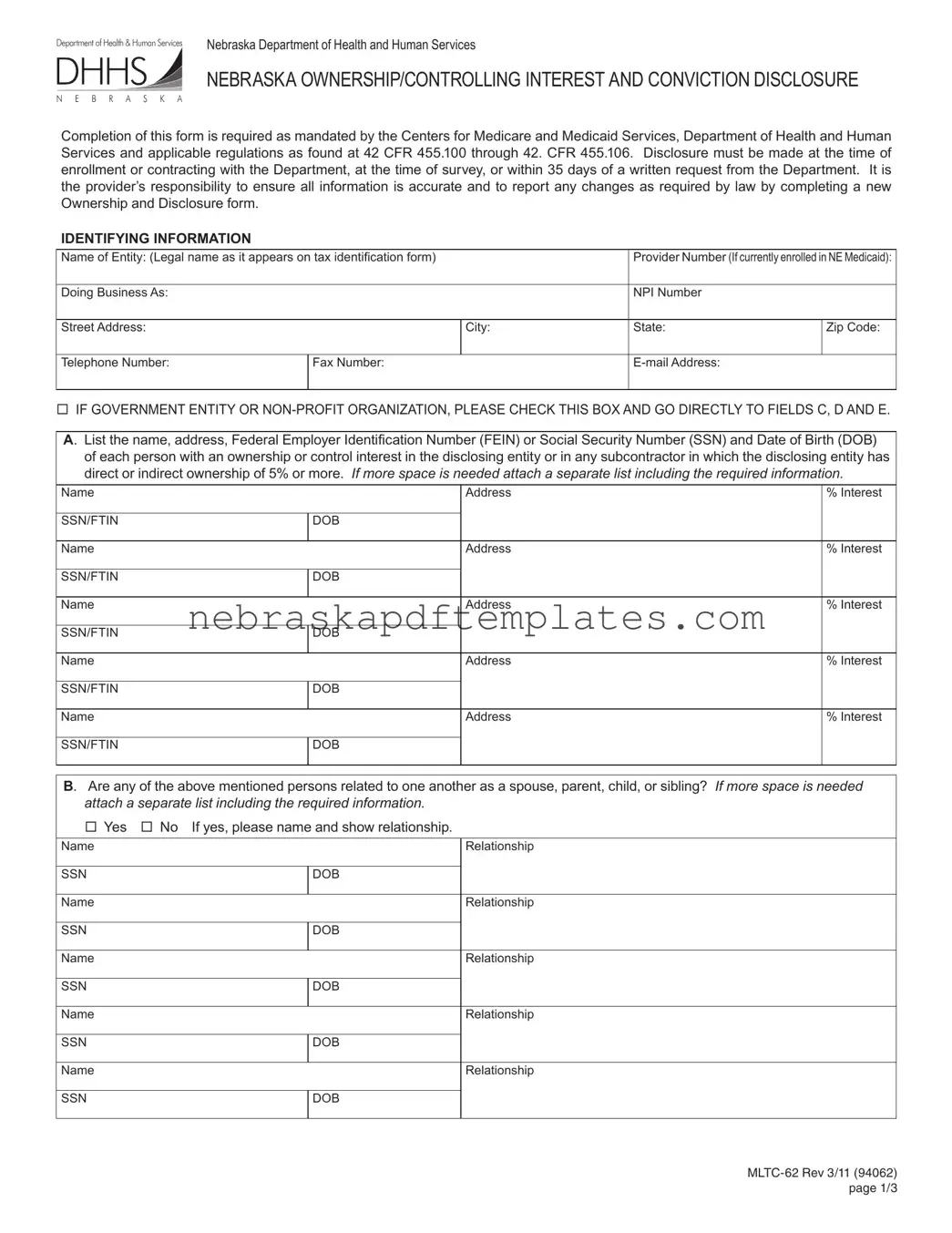

Blank Mltc 62 Nebraska PDF Template

The MLTC 62 Nebraska form is a document required by the Nebraska Department of Health and Human Services for the disclosure of ownership and controlling interest, as well as any relevant criminal convictions. This form must be completed by entities seeking enrollment or contracting with the Department, and it is critical to ensure accuracy in the provided information. Timely completion of this form is essential to comply with federal regulations, so take action now by filling out the form below.

Access Editor Here

Blank Mltc 62 Nebraska PDF Template

Access Editor Here

Finish your form now

Finalize Mltc 62 Nebraska online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Mltc 62 Nebraska