Attorney-Verified Motor Vehicle Bill of Sale Document for Nebraska

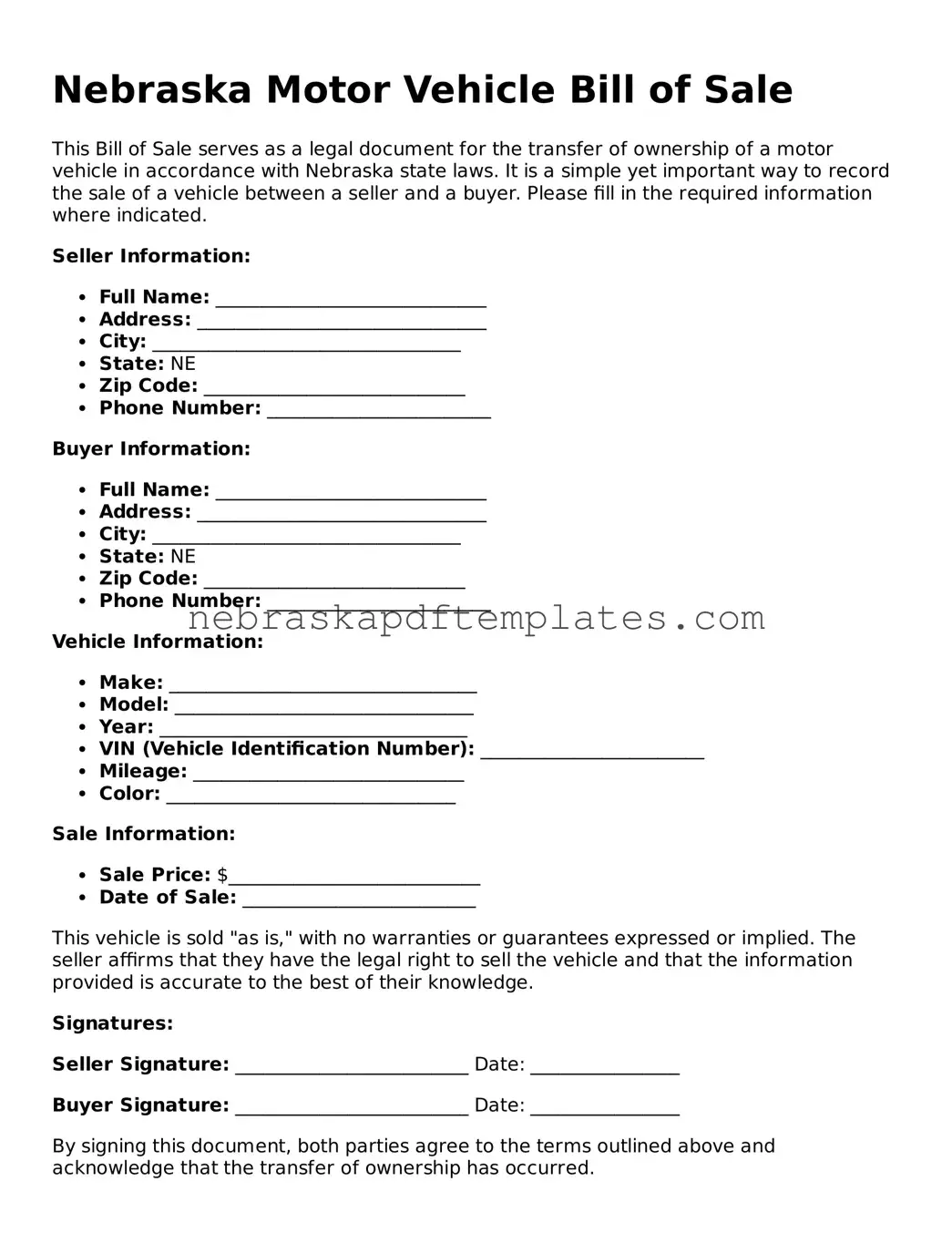

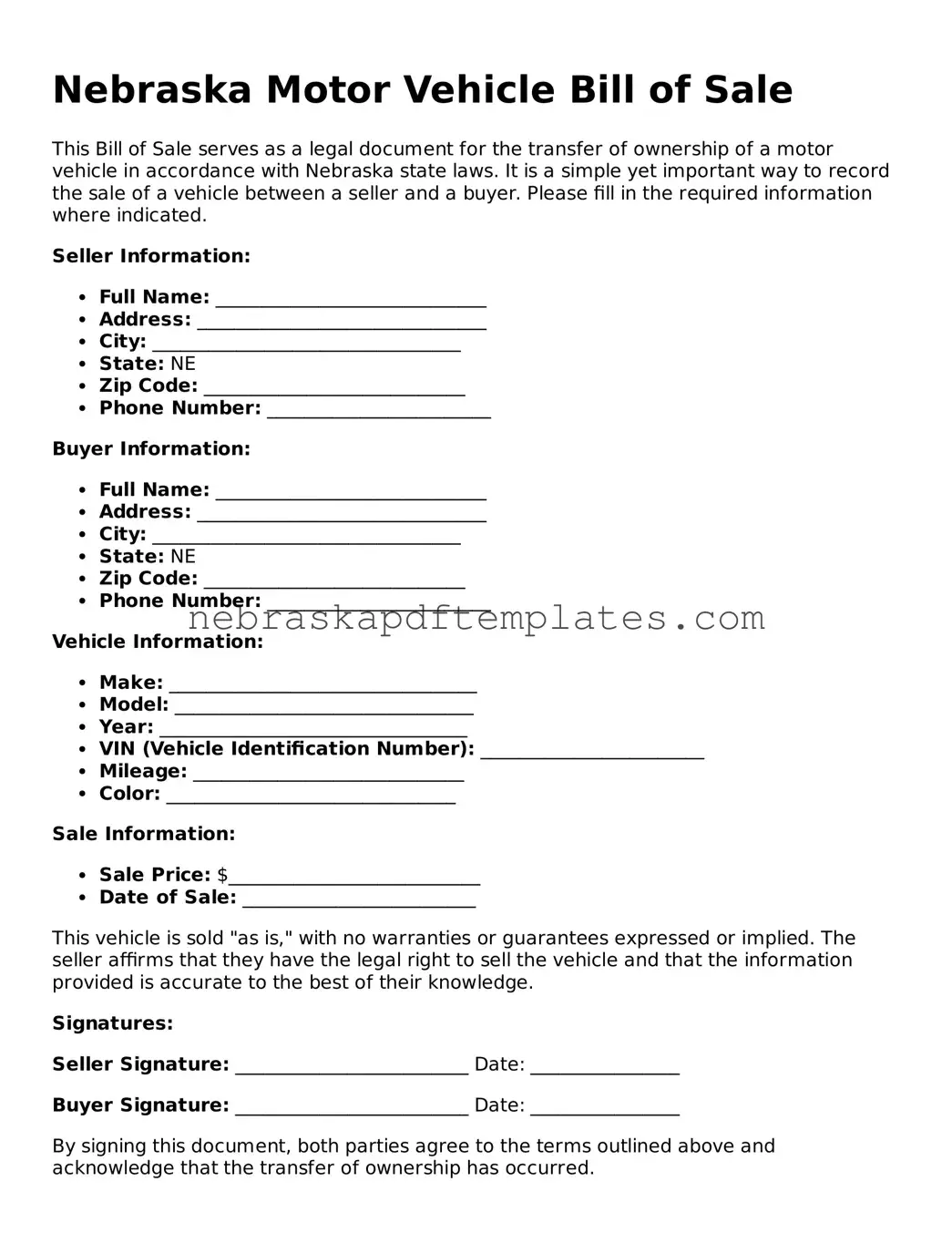

The Nebraska Motor Vehicle Bill of Sale form is a legal document that records the transfer of ownership of a vehicle from one party to another. This form serves as proof of the transaction and includes essential details such as the vehicle's make, model, and VIN. To ensure a smooth transfer, it’s important to fill out the form accurately; click the button below to get started.

Access Editor Here

Attorney-Verified Motor Vehicle Bill of Sale Document for Nebraska

Access Editor Here

Finish your form now

Finalize Motor Vehicle Bill of Sale online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Motor Vehicle Bill of Sale