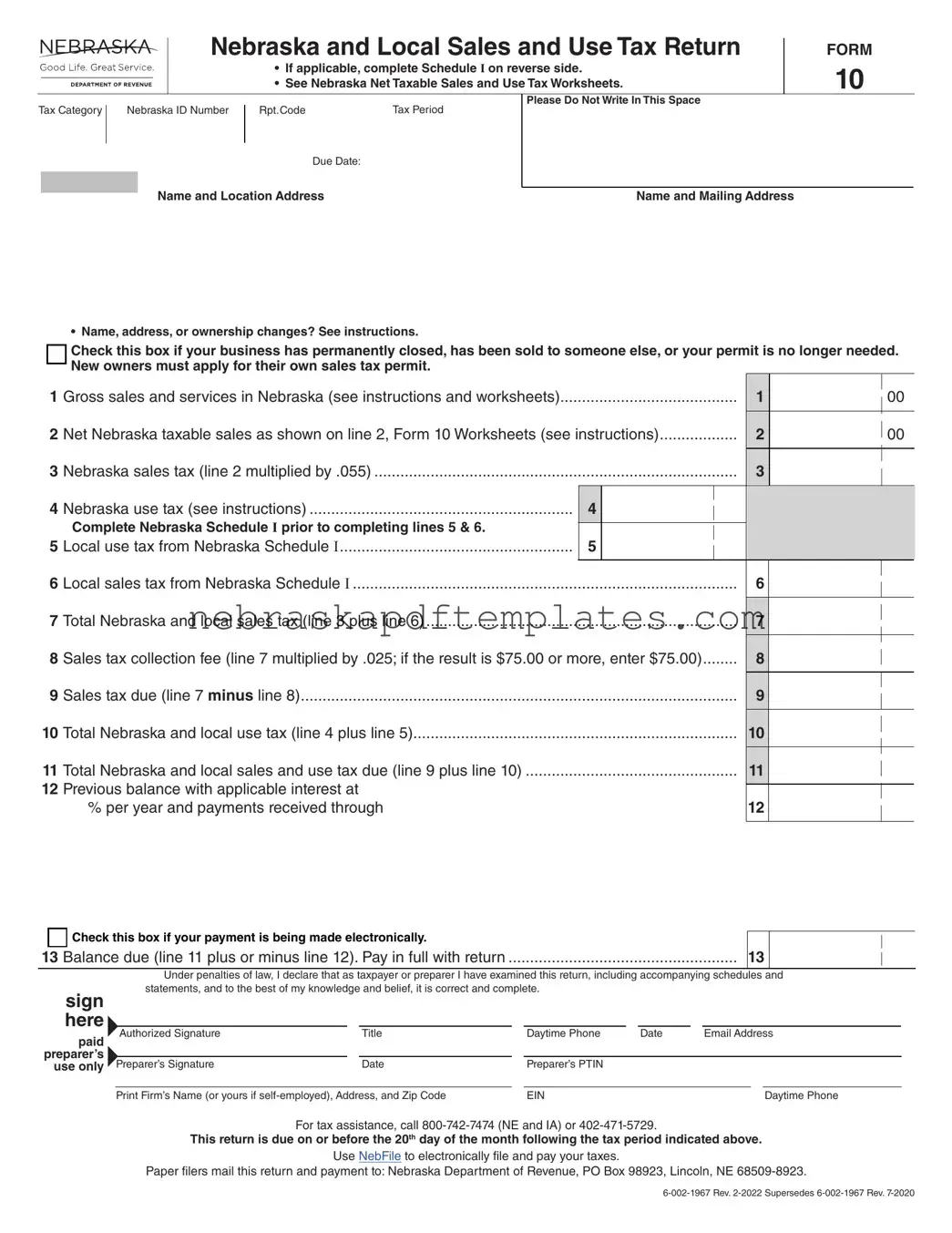

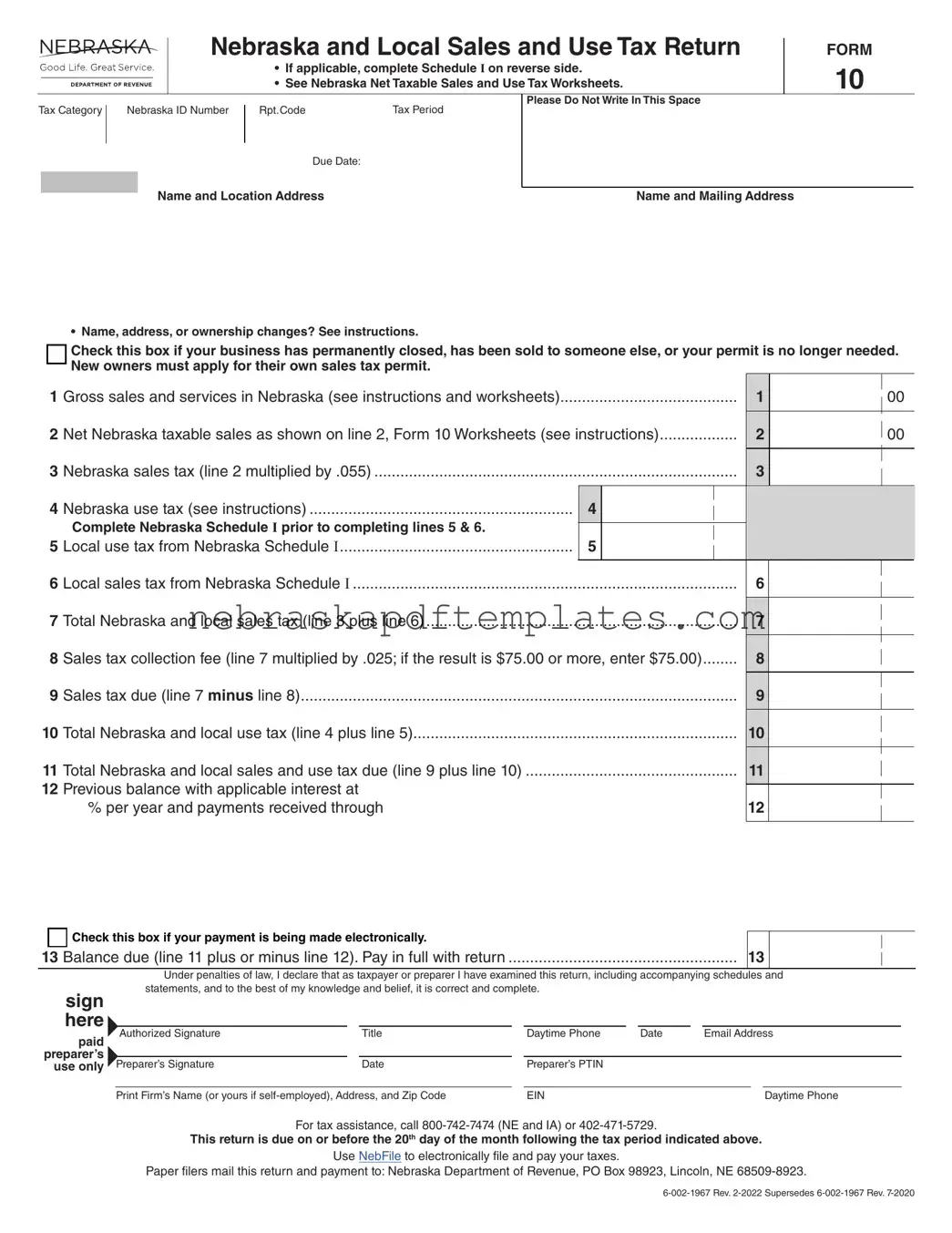

The Nebraska 10 form is the official document used to report sales and use tax in the state of Nebraska. Businesses that make taxable sales or use taxable items in Nebraska must complete this form. It includes sections for reporting gross sales, net taxable sales, and various tax calculations. The form must be submitted to the Nebraska Department of Revenue by the due date specified for each tax period.

Any business that sells goods or services in Nebraska and is required to collect sales tax must file the Nebraska 10 form. This includes retailers, wholesalers, and service providers. Additionally, businesses that purchase items for use in Nebraska without paying sales tax must also file this form to report and pay the applicable use tax.

The Nebraska 10 form is due on or before the 20th day of the month following the end of the tax period indicated on the form. For example, if the tax period ends on December 31, the form must be filed by January 20 of the following year.

How do I calculate the Nebraska sales tax owed?

To calculate the Nebraska sales tax owed, follow these steps:

-

Determine your net taxable sales, which is reported on line 2 of the form.

-

Multiply the net taxable sales by the state sales tax rate of 5.5% (0.055).

-

If applicable, add any local sales tax calculated from Schedule I.

-

Subtract any sales tax collection fees, if applicable, from the total tax due.

What if my business has closed or changed ownership?

If your business has closed, you should check the appropriate box on the Nebraska 10 form to cancel your permit. If your business has been sold, the new owners must apply for their own permit. For ownership changes, update your information on the form as instructed.

What is Schedule I and why do I need it?

Schedule I is a supplemental form that must be attached to the Nebraska 10 form if local sales or use taxes apply. It includes specific local tax rates for various cities in Nebraska. Completing Schedule I ensures that you accurately report any local taxes owed in addition to the state sales tax.

How can I pay my Nebraska sales tax?

You can pay your Nebraska sales tax electronically or by mail. If paying electronically, indicate this on the form. For paper filers, mail the completed Nebraska 10 form and payment to the Nebraska Department of Revenue at the specified address. Ensure that your payment is included with the return to avoid penalties.

If you have questions regarding the Nebraska 10 form or need assistance, you can contact the Nebraska Department of Revenue. They provide a dedicated helpline for tax assistance at 800-742-7474 (for Nebraska and Iowa) or 402-471-5729. Additionally, the department's website offers resources and guidance on completing the form and understanding tax obligations.