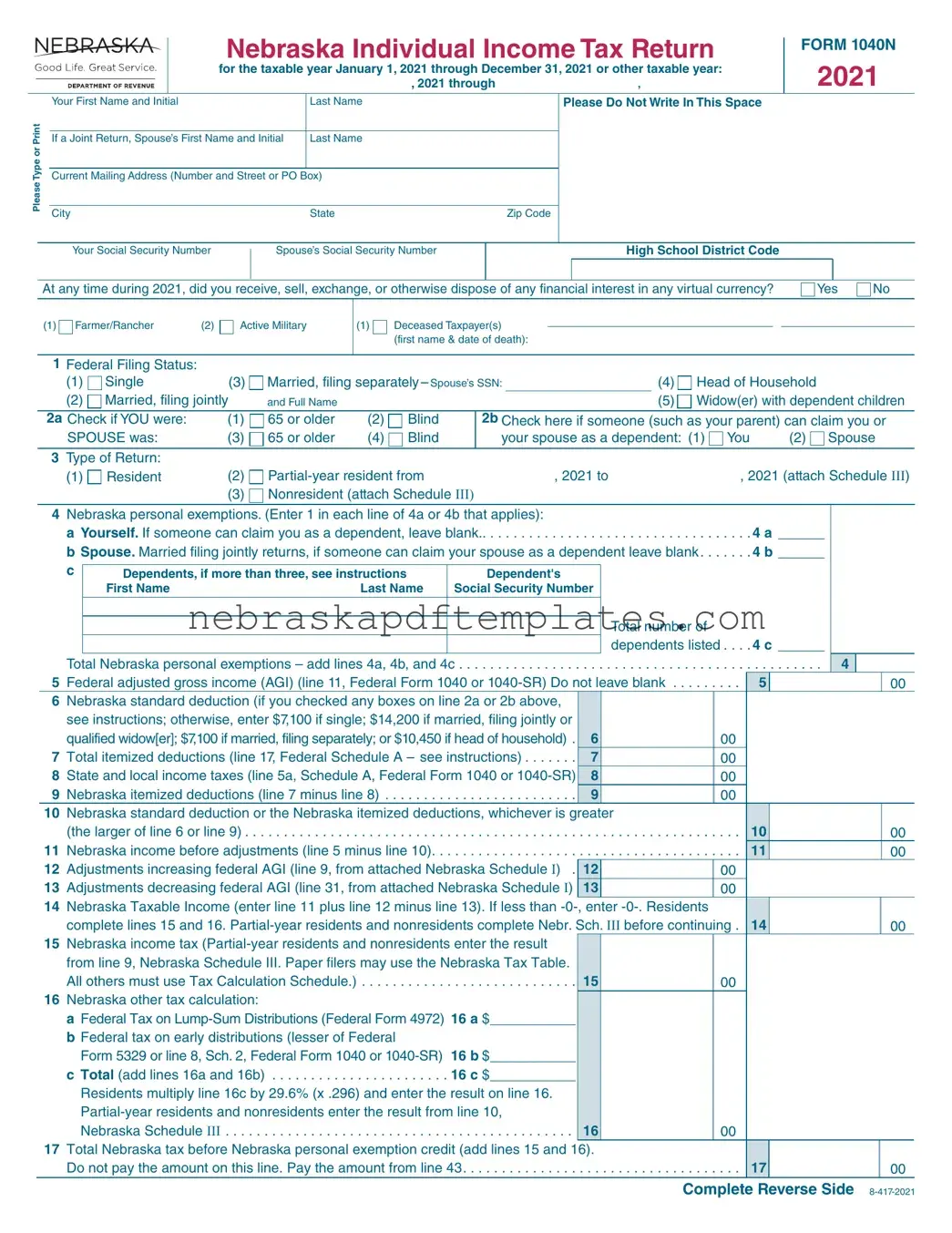

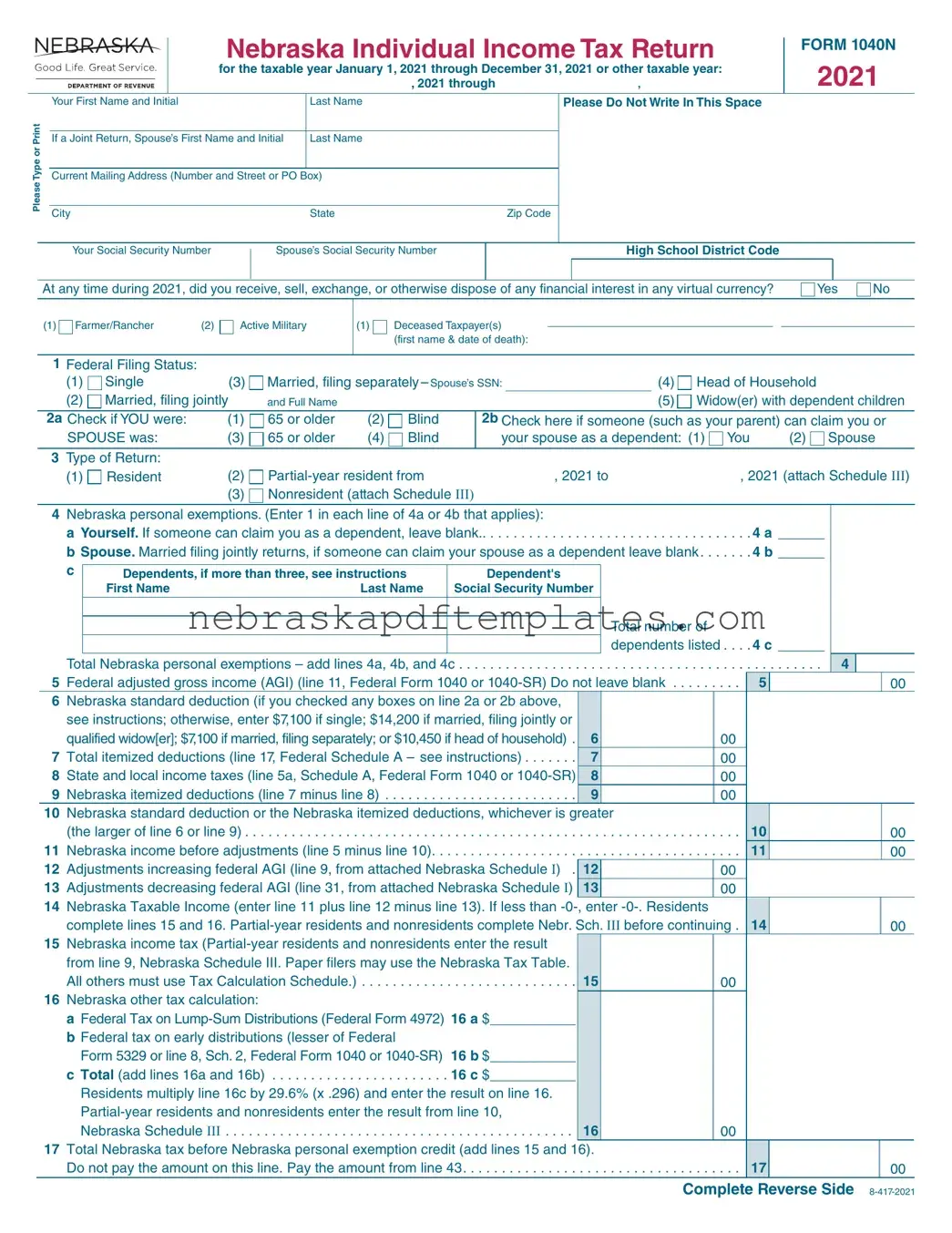

The Nebraska 1040N form is the state income tax return for residents, partial-year residents, and nonresidents of Nebraska. It is used to report income earned within the state, calculate tax liability, and claim any applicable deductions or credits. This form is specifically for the taxable year, which typically runs from January 1 to December 31. For example, the 2020 form covers income earned during that calendar year.

Individuals who are residents, partial-year residents, or nonresidents of Nebraska and have earned income from Nebraska sources must file the 1040N form. This includes those who have a filing requirement based on their income level or those who wish to claim a refund for overpaid taxes. If you are a nonresident, you will need to attach Schedule III to report your income accurately.

To complete the 1040N form, you will need various pieces of information, including:

-

Your name and Social Security Number (SSN).

-

Your spouse's name and SSN if filing jointly.

-

Your current mailing address.

-

Your federal adjusted gross income (AGI) from your federal tax return.

-

Details about any dependents you are claiming.

-

Information about any deductions you are eligible for, such as the standard deduction or itemized deductions.

How do I determine my Nebraska taxable income?

Your Nebraska taxable income is calculated by taking your federal adjusted gross income (AGI) and making adjustments for Nebraska-specific deductions. Start with your AGI, subtract either the Nebraska standard deduction or your total itemized deductions (whichever is greater), and then apply any additional adjustments as needed. The final result is your Nebraska taxable income.

The standard deduction amounts for the 1040N form vary based on your filing status:

-

$7,000 for single filers

-

$14,000 for married couples filing jointly or qualified widow(er)s

-

$7,000 for married individuals filing separately

-

$10,300 for head of household filers

Be sure to check the instructions for any additional considerations that may apply to your situation.

The 1040N form allows for various credits that can reduce your tax liability. Some of these include:

-

Nebraska personal exemption credit

-

Credit for tax paid to another state

-

Credit for the elderly or disabled

-

Community Development Assistance Act credit

-

Child/dependent care credits

Make sure to review the specific eligibility requirements for each credit before claiming them.

Where you send your completed 1040N form depends on whether you are requesting a refund or not. If you are expecting a refund, mail your form to:

Nebraska Department of Revenue, PO Box 98912, Lincoln, NE 68509-8912.

If you are not requesting a refund, send it to:

Nebraska Department of Revenue, PO Box 98934, Lincoln, NE 68509-8934.

Always keep a copy of your return for your records.