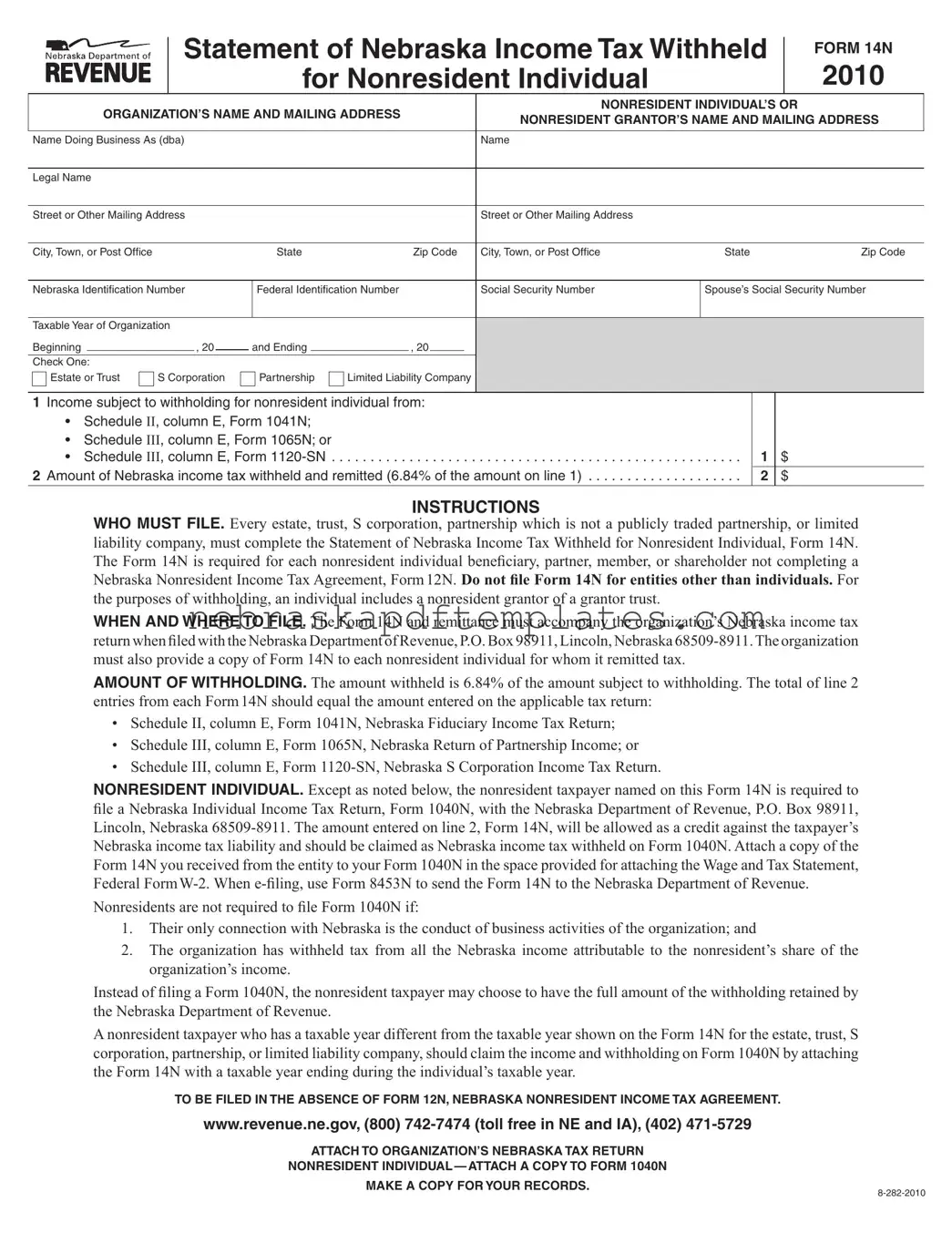

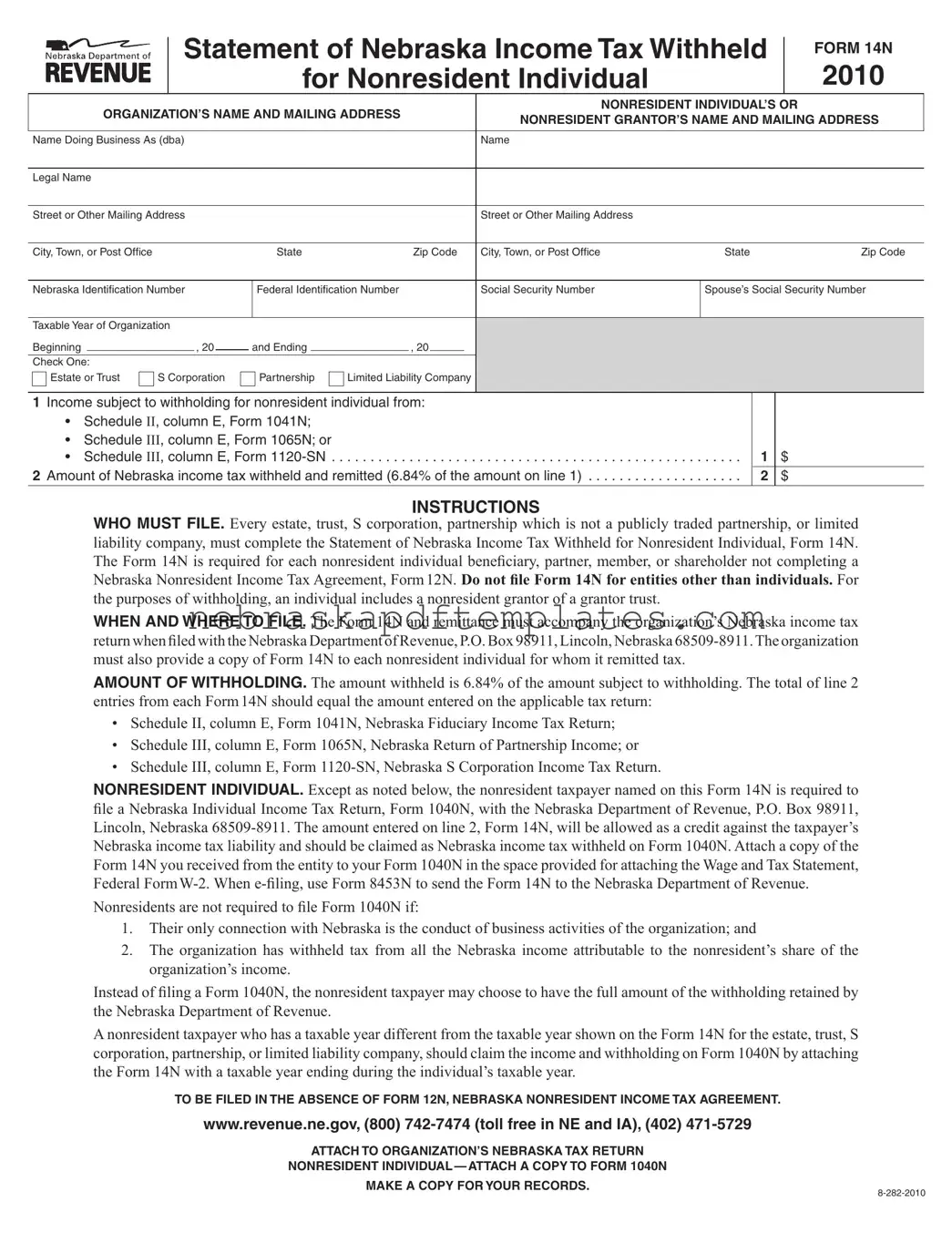

Blank Nebraska 14N PDF Template

The Nebraska 14N form serves as the Statement of Nebraska Income Tax Withheld for Nonresident Individuals. This form is essential for various organizations, including estates, trusts, and partnerships, to report income tax withheld from nonresident individuals. Understanding its requirements and processes is crucial for compliance, so be sure to fill out the form by clicking the button below.

Access Editor Here

Blank Nebraska 14N PDF Template

Access Editor Here

Finish your form now

Finalize Nebraska 14N online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Nebraska 14N