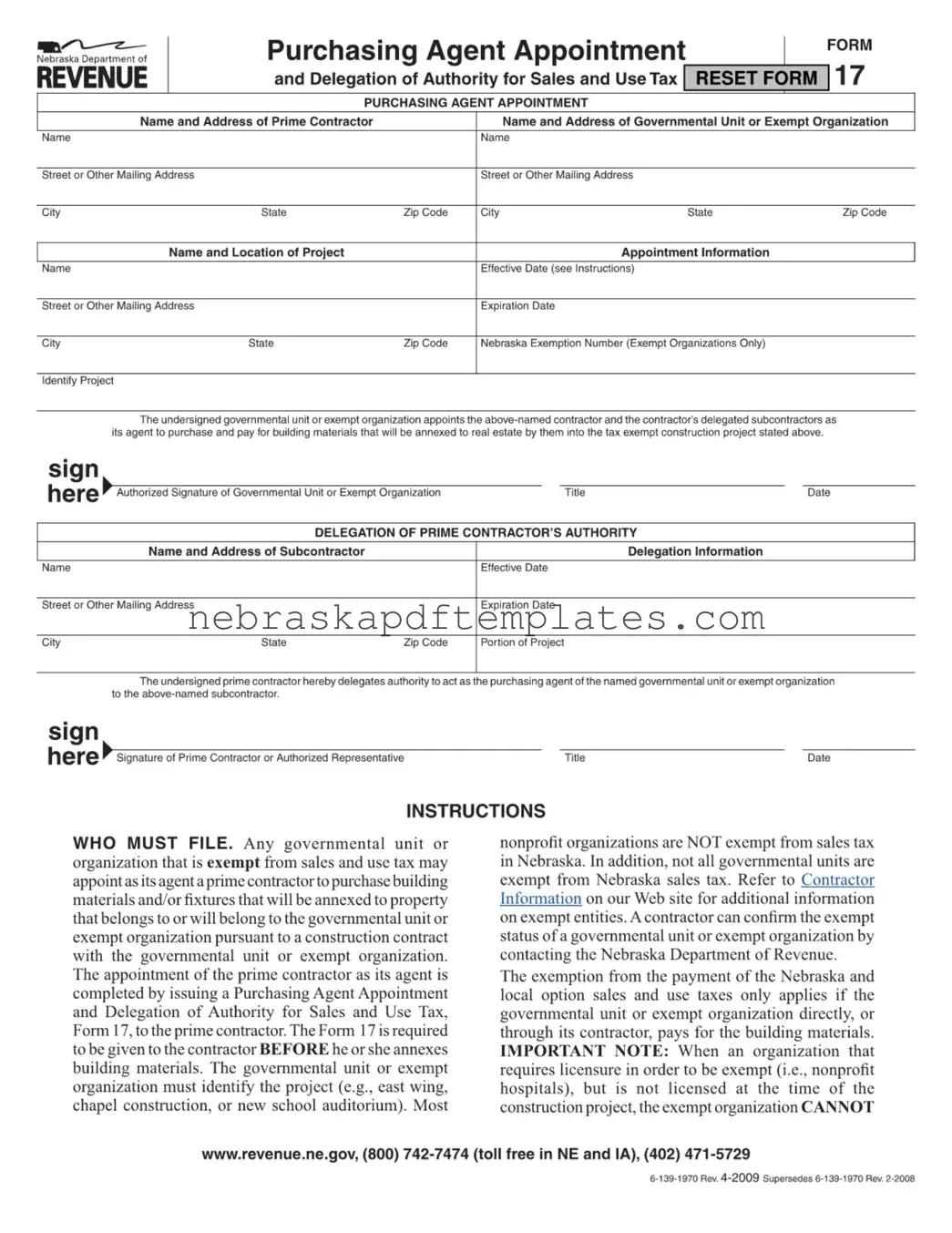

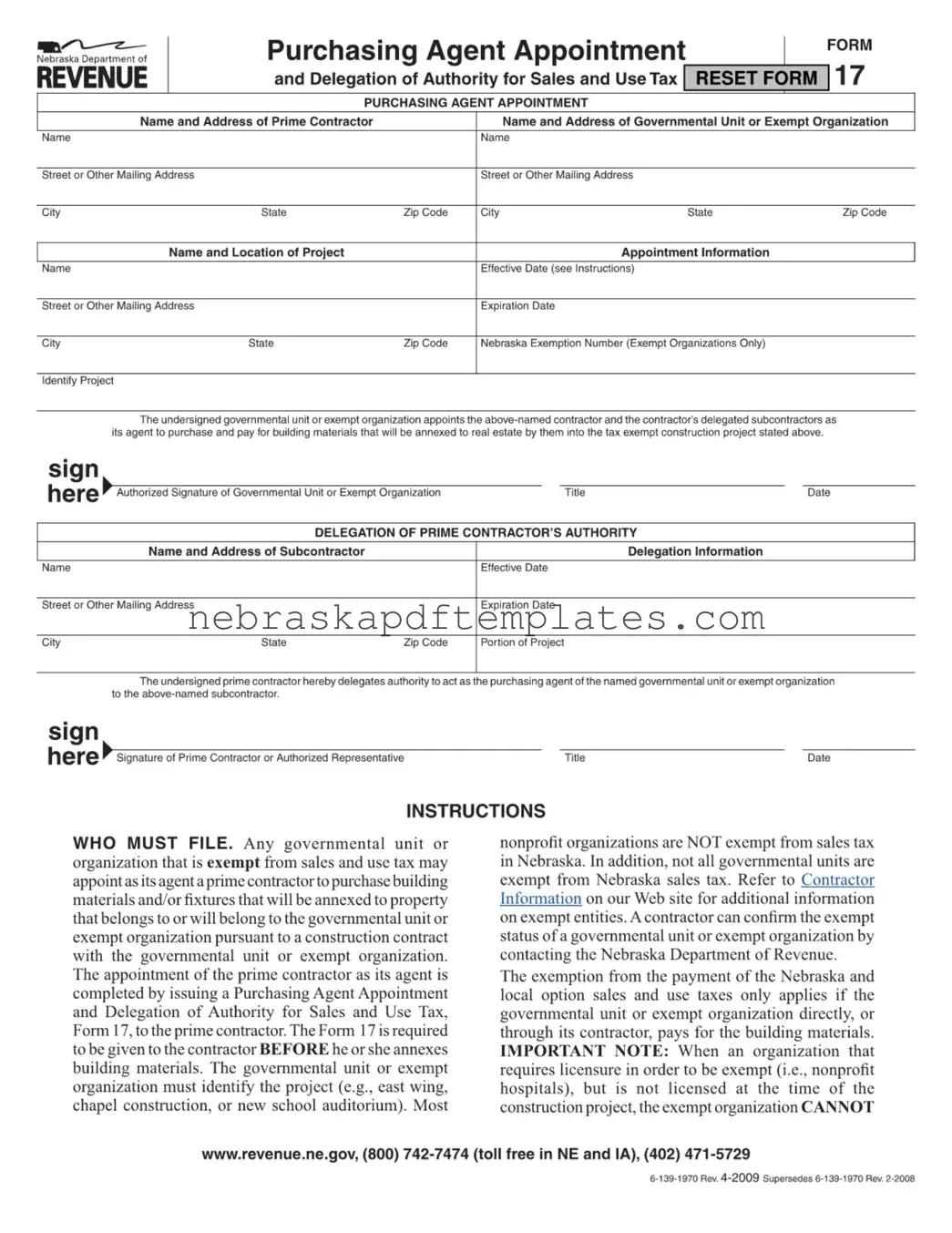

The Nebraska 17 form, also known as the Purchasing Agent Appointment and Delegation of Authority for Sales and Use Tax, is a document used by governmental units or exempt organizations in Nebraska. It allows these entities to appoint a prime contractor as their purchasing agent. This appointment enables the contractor to purchase building materials and fixtures for construction projects that will be annexed to property owned or to be owned by the governmental unit or exempt organization without incurring sales tax.

Any governmental unit or organization that is exempt from sales and use tax in Nebraska may file the Nebraska 17 form. This includes entities that have a construction contract with a prime contractor. It is important to note that not all governmental units or nonprofit organizations are exempt from sales tax. Therefore, it is advisable to verify the exempt status by contacting the Nebraska Department of Revenue.

The Nebraska 17 form must be completed and issued to the prime contractor before any building materials are annexed to the project. If the form is not provided prior to the annexation, the contractor will be responsible for paying the sales and use taxes. The governmental unit or exempt organization may then seek a refund of the taxes paid by the contractor.

A copy of the completed Nebraska 17 form should be retained by the governmental unit or exempt organization that issues the form. The original form must be kept by the prime contractor. If the prime contractor delegates authority to any subcontractors, copies of the form must be made for them as well.

The Nebraska 17 form requires several key pieces of information, including:

-

Name and address of the prime contractor

-

Name and address of the governmental unit or exempt organization

-

Details of the construction project, including its name and location

-

Effective and expiration dates of the appointment

-

Nebraska exemption number for exempt organizations

Accurate completion of this information is essential for the form to be valid.

Can a prime contractor delegate authority to a subcontractor?

Yes, a prime contractor can delegate authority to act as a purchasing agent to a subcontractor. The prime contractor must complete a separate Nebraska 17 form for each subcontractor who is granted this authority. The subcontractor must retain a copy of the form for their records, and copies must also be provided to the governmental unit or exempt organization.

What happens if the project is not completed within the effective dates?

If the construction project is not completed within the effective and expiration dates specified on the Nebraska 17 form, the governmental unit or exempt organization must issue a new form to extend the appointment. The original form will not remain valid beyond the expiration date, and any purchases made after this date will require payment of sales tax.

What is the Exempt Sale Certificate?

The Exempt Sale Certificate, specifically Form 13, must be provided by the prime contractor to any subcontractor operating as an Option 1 contractor. This certificate, along with a completed Nebraska 17 form, allows the subcontractor to avoid charging sales tax on materials annexed to the specific project. If these forms are not provided, the subcontractor is required to collect and remit sales tax on the applicable materials.