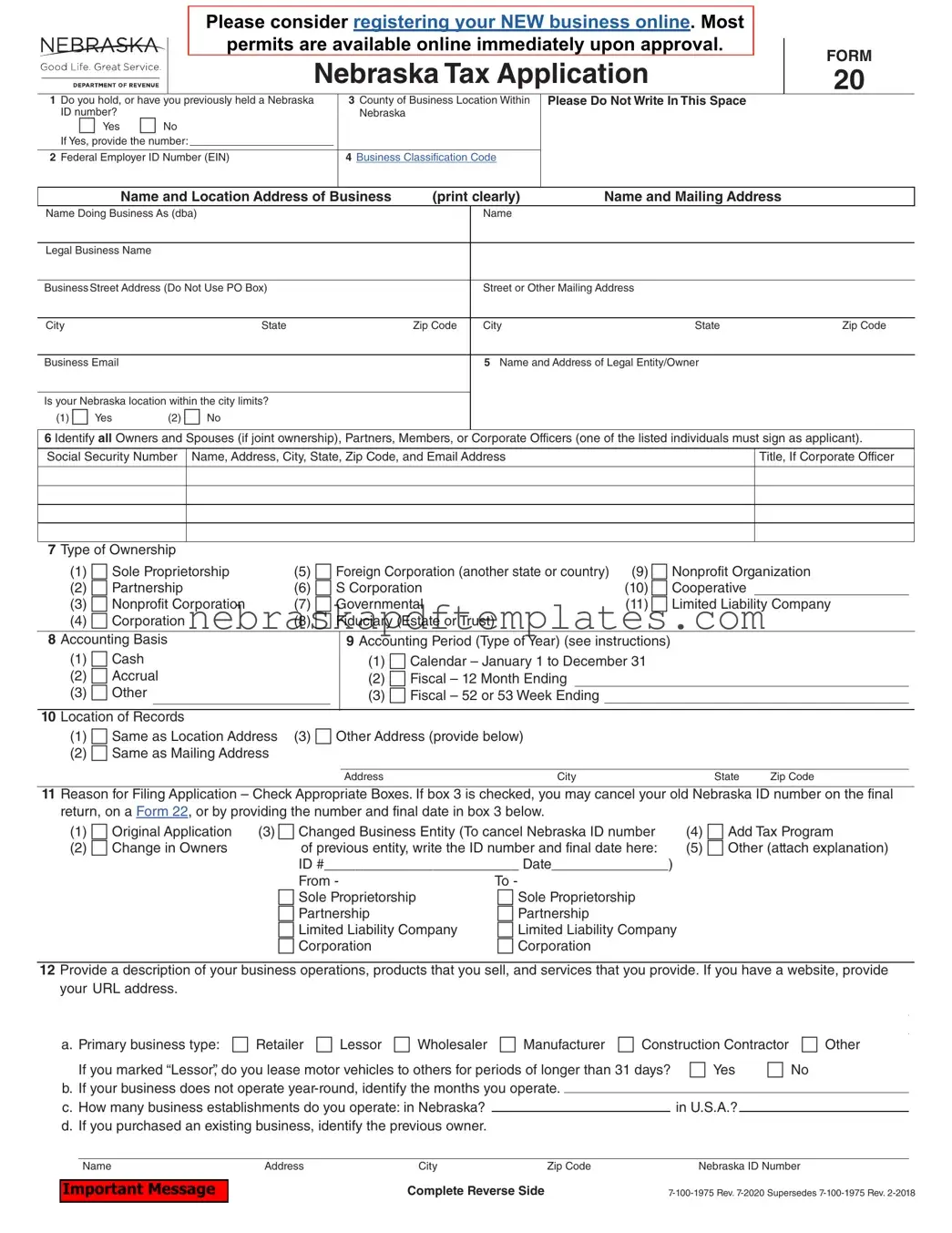

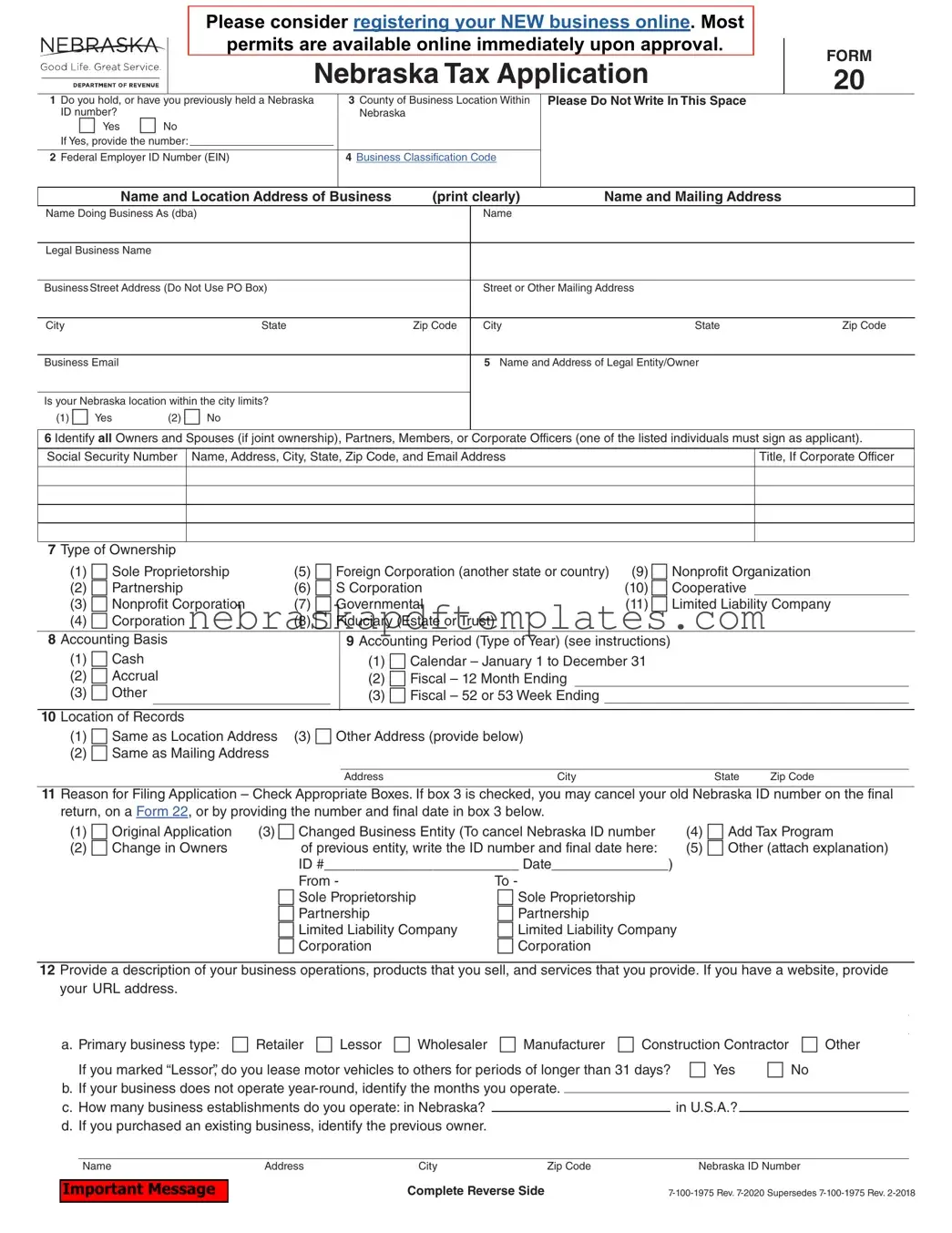

Blank Nebraska 20 PDF Template

The Nebraska 20 form is a vital application used by businesses to register for various tax programs in Nebraska. This form facilitates the process of obtaining necessary permits and licenses for operating legally within the state. If you're starting a new business or changing ownership, it’s essential to complete this form accurately to ensure compliance with state regulations.

Ready to get started? Fill out the Nebraska 20 form by clicking the button below.

Access Editor Here

Blank Nebraska 20 PDF Template

Access Editor Here

Finish your form now

Finalize Nebraska 20 online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Nebraska 20