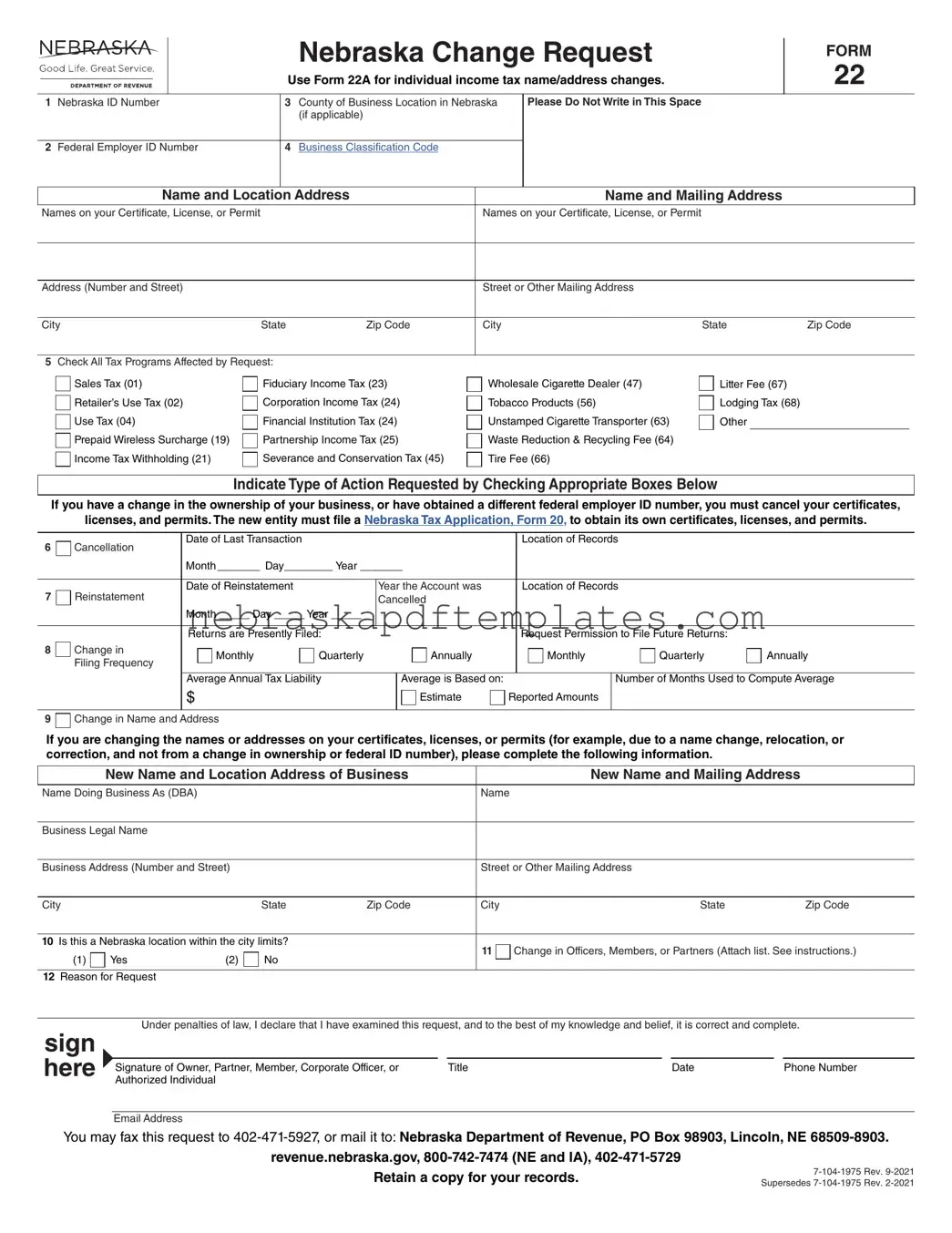

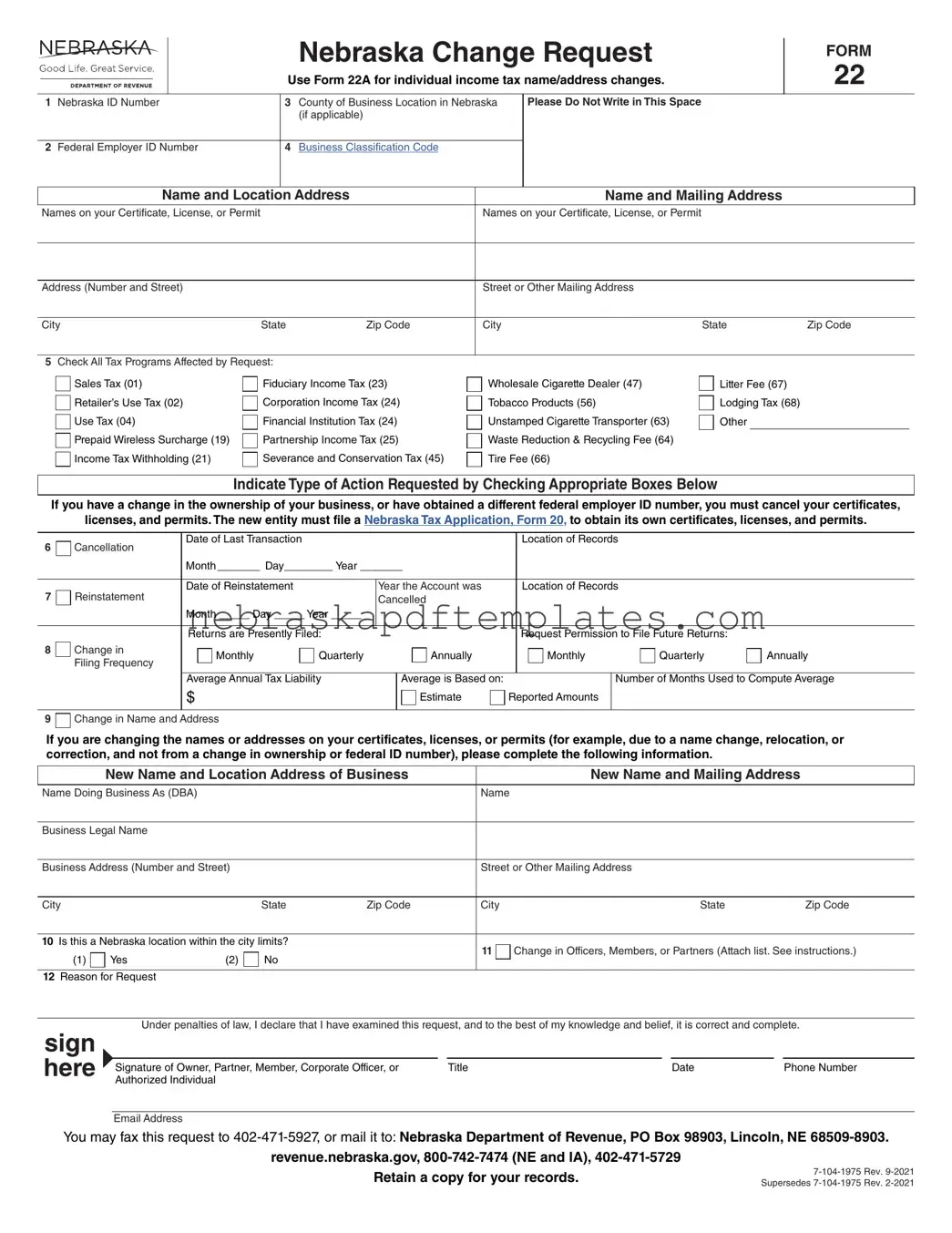

Blank Nebraska 22 PDF Template

The Nebraska Change Request Form 22 is a document used by taxpayers to update their name or address related to various tax certificates, licenses, or permits. This form is essential for anyone needing to make changes due to relocation, ownership changes, or corrections. If you need to fill out this form, please click the button below to get started.

Access Editor Here

Blank Nebraska 22 PDF Template

Access Editor Here

Finish your form now

Finalize Nebraska 22 online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Nebraska 22