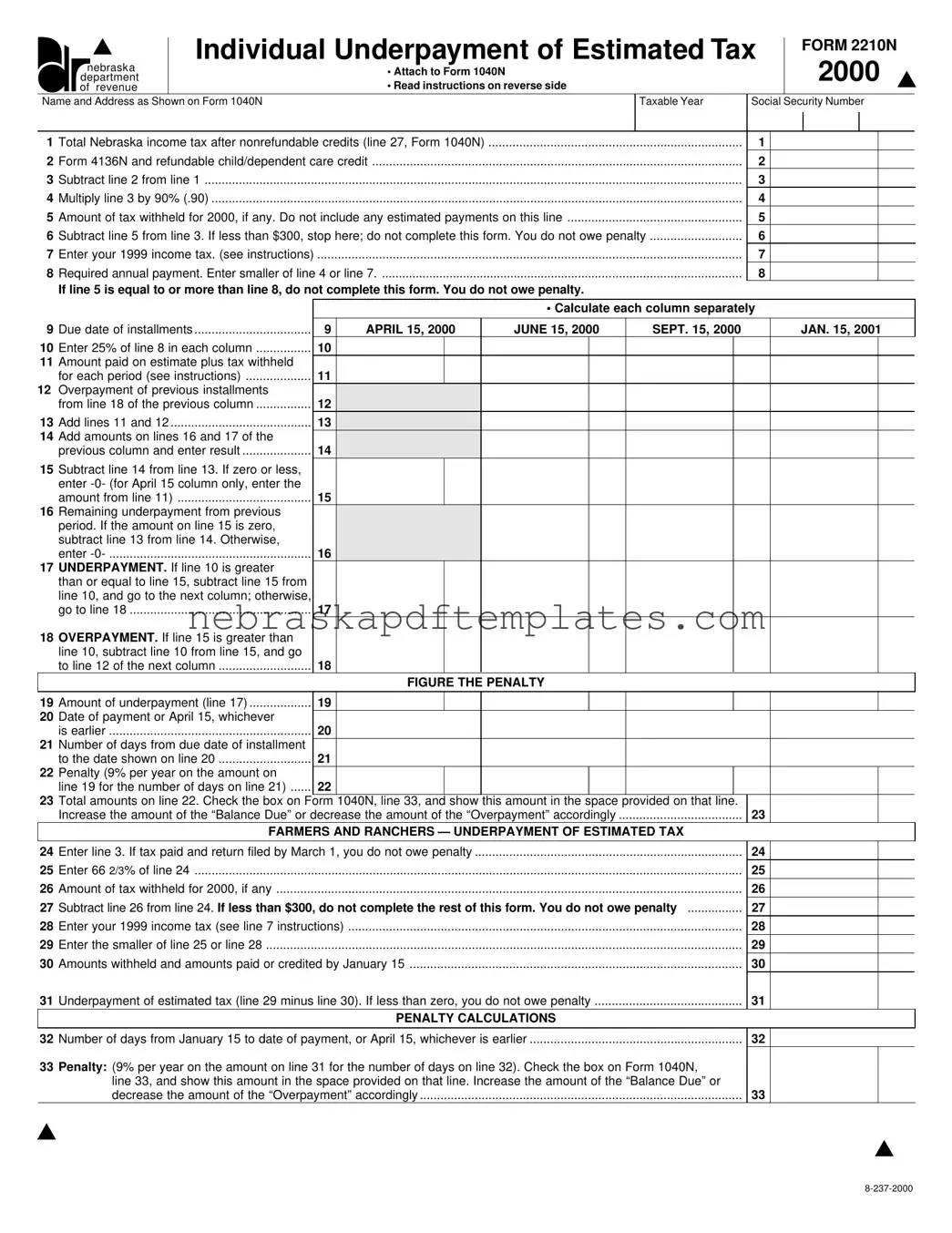

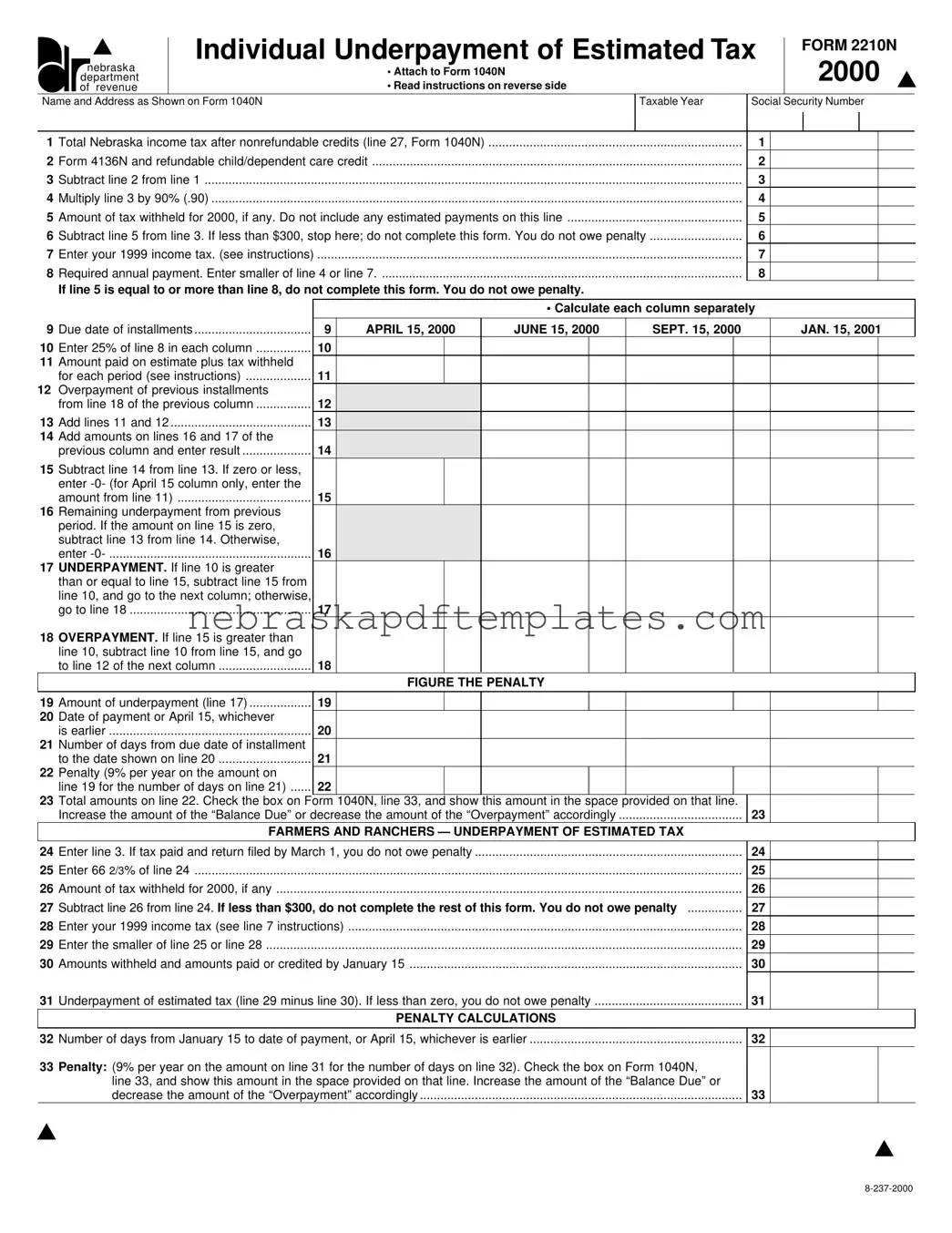

Blank Nebraska 2210N PDF Template

The Nebraska 2210N form is a crucial document for individuals who need to report an underpayment of estimated tax in the state of Nebraska. This form must be attached to your Nebraska Individual Income Tax Return, Form 1040N, and is used to calculate any penalties owed for insufficient tax payments throughout the year. It’s essential to complete this form accurately to avoid unexpected penalties, so take action now by filling it out using the button below.

Access Editor Here

Blank Nebraska 2210N PDF Template

Access Editor Here

Finish your form now

Finalize Nebraska 2210N online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Nebraska 2210N