Blank Nebraska 22A PDF Template

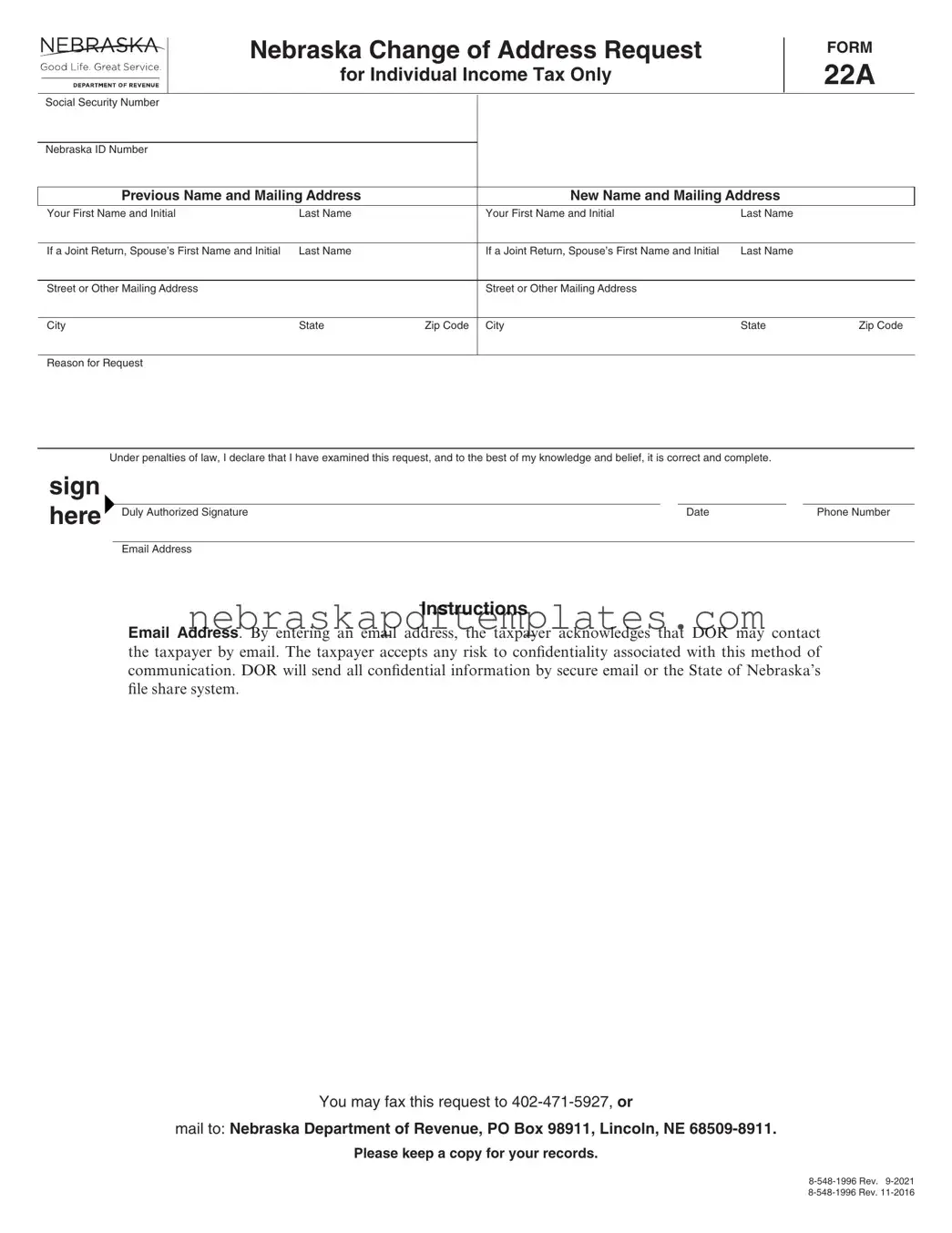

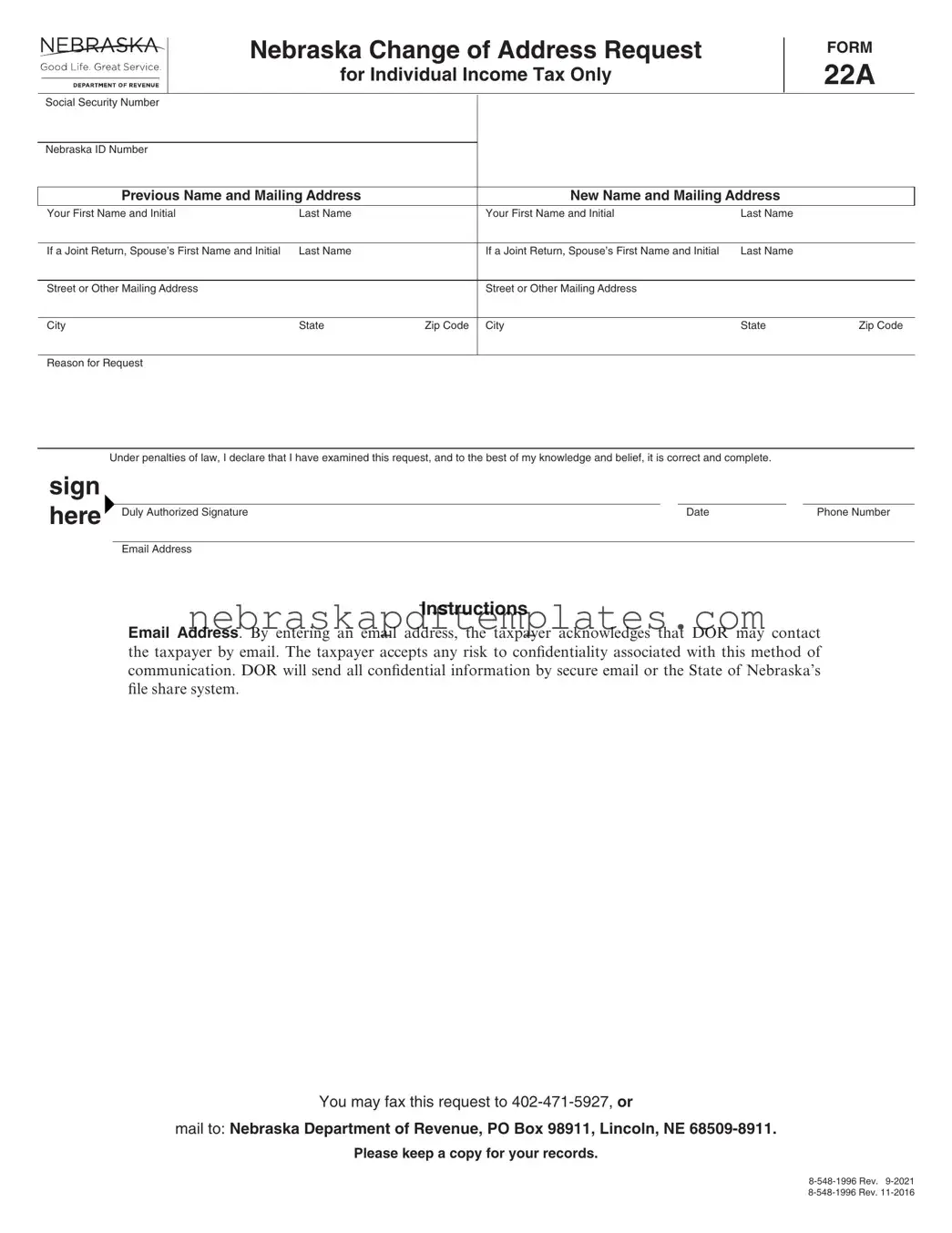

The Nebraska Change of Address Request for Individual Income Tax Only FORM 22A is a document used by individuals to officially notify the Nebraska Department of Revenue of a change in their mailing address. This form requires personal information, including your Social Security number and previous and new addresses. Completing this form accurately is essential to ensure that all tax-related correspondence is sent to the correct location.

To fill out the form, please click the button below.

Access Editor Here

Blank Nebraska 22A PDF Template

Access Editor Here

Finish your form now

Finalize Nebraska 22A online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Nebraska 22A