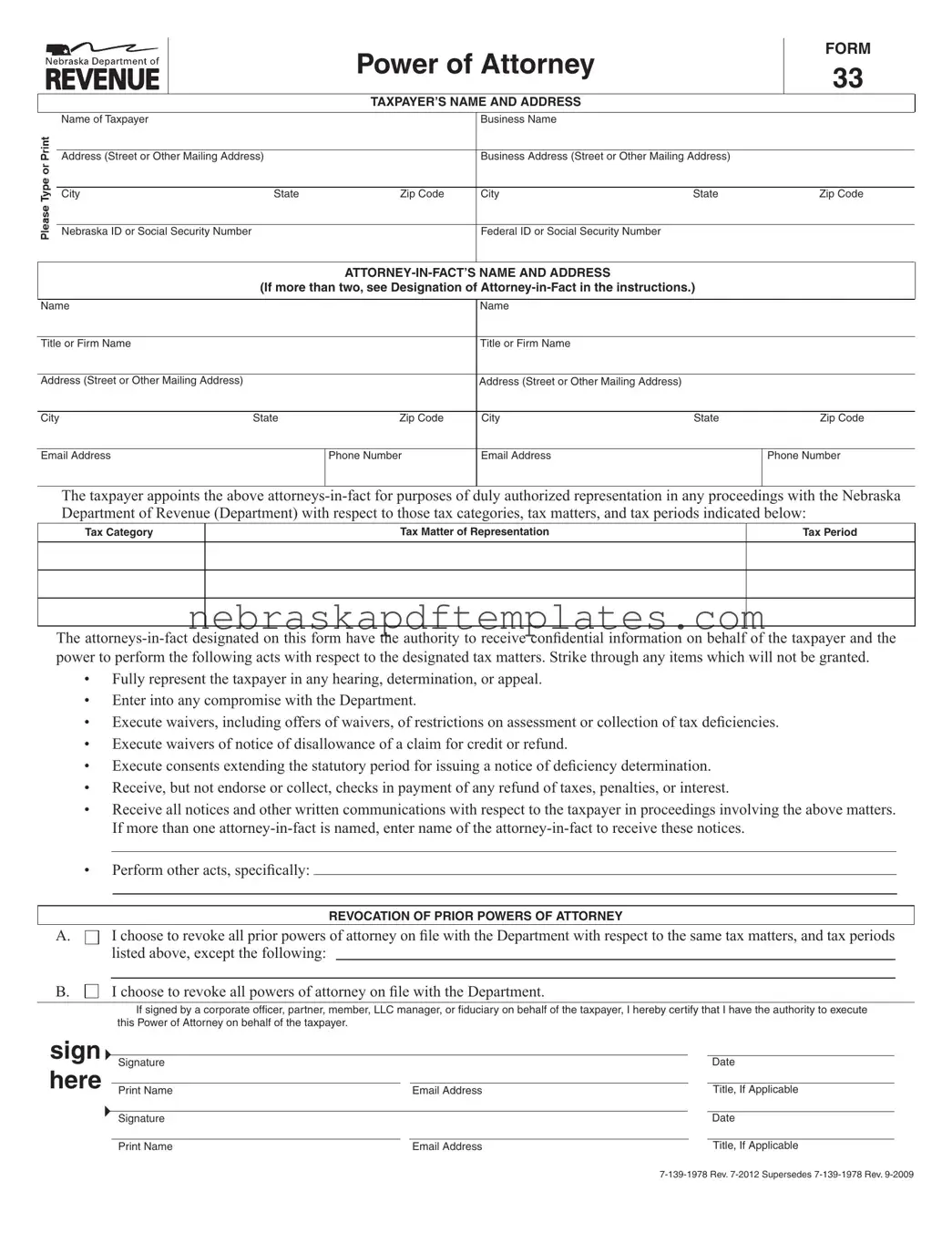

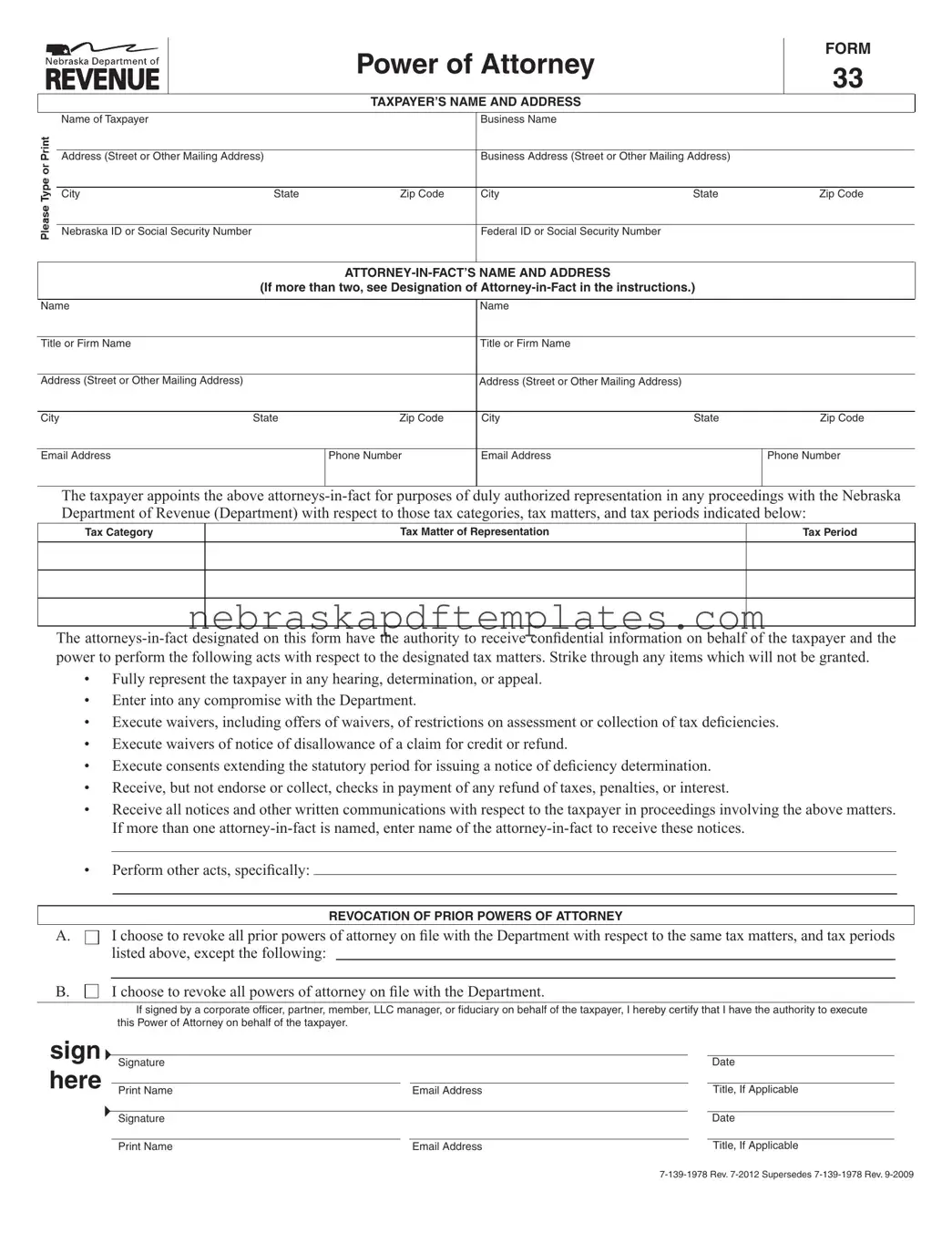

The Nebraska 33 form is a Power of Attorney document specifically designed for taxpayers who wish to appoint another individual or entity to represent them in matters before the Nebraska Department of Revenue. This form allows the appointed representatives, known as attorneys-in-fact, to receive confidential tax information and act on behalf of the taxpayer in various tax-related matters.

Any taxpayer who wants to secure representation for tax matters with the Nebraska Department of Revenue must file the Nebraska 33 form. This includes individuals, corporations, partnerships, and estates. If a taxpayer wishes to allow someone else to handle their tax issues, such as audits or appeals, they must complete this form to grant the necessary authority.

The completed Nebraska 33 form can be filed at any time. It must be submitted to the Nebraska Department of Revenue before the appointed representative can act on behalf of the taxpayer. There are multiple ways to file the form: it can be emailed to rev.poa@nebraska.gov, faxed to 402-471-5608, or mailed to the Nebraska Department of Revenue at PO Box 94818, Lincoln, NE 68509-4818.

The form requires several key pieces of information:

-

The taxpayer's name, address, and identification numbers (Social Security or Federal ID).

-

The names and addresses of the attorneys-in-fact being appointed.

-

A clear indication of the tax categories, tax matters, and tax periods for which representation is granted.

-

Any specific acts that the attorneys-in-fact are authorized to perform.

It is crucial that all information is accurately filled out to avoid any issues with representation.

Yes, the Nebraska 33 form includes a section for revoking prior Powers of Attorney. Taxpayers can choose to revoke all previous authorizations or only specific ones. To do this, they must check the appropriate box on the form and provide any necessary details about the prior Powers of Attorney that are to remain in effect.

If there are specific acts that the taxpayer wishes to authorize that are not included in the standard list on the Nebraska 33 form, they can do so by writing a concise statement in the designated space provided. Alternatively, a separate signed statement can be attached to the form to specify any additional authorizations.