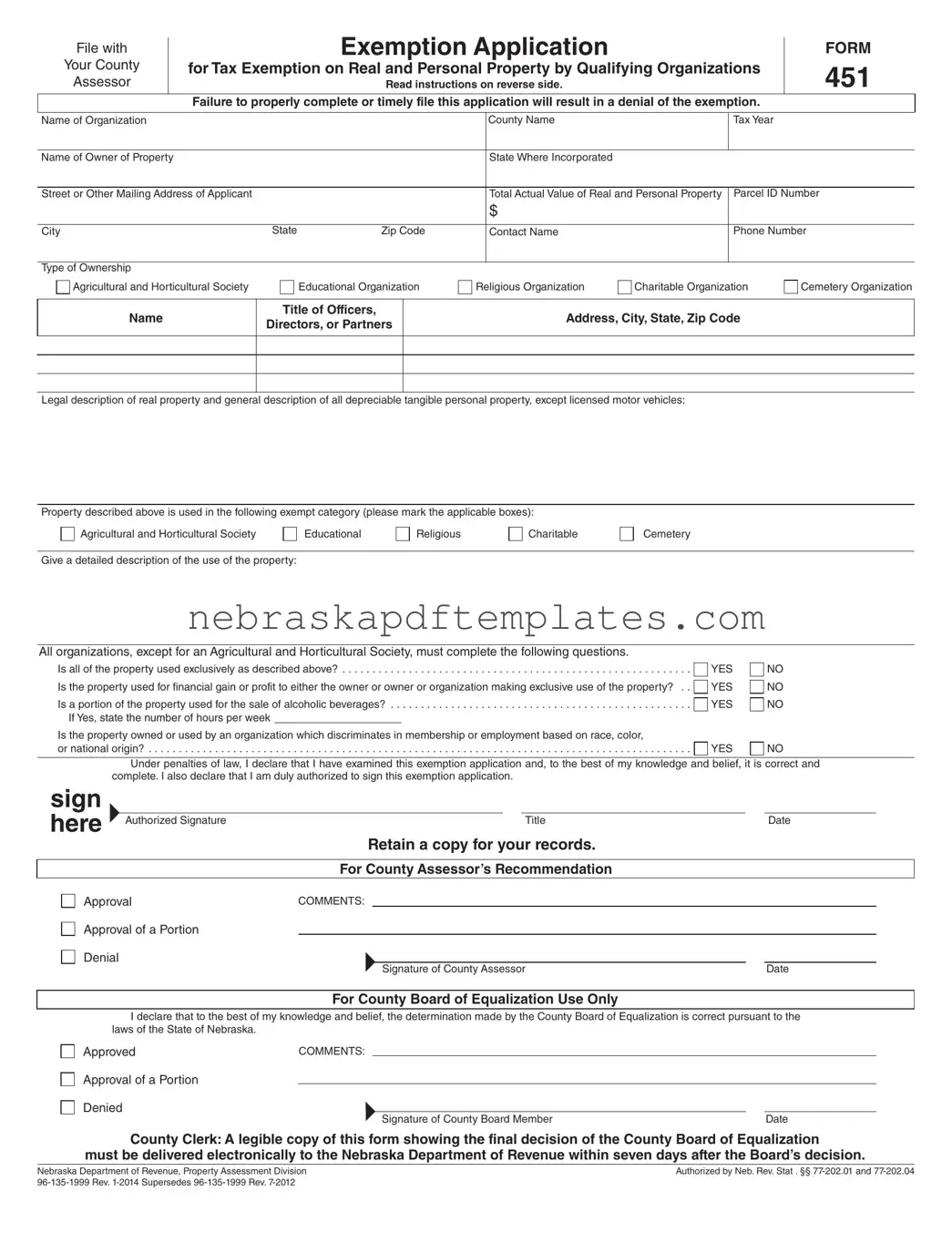

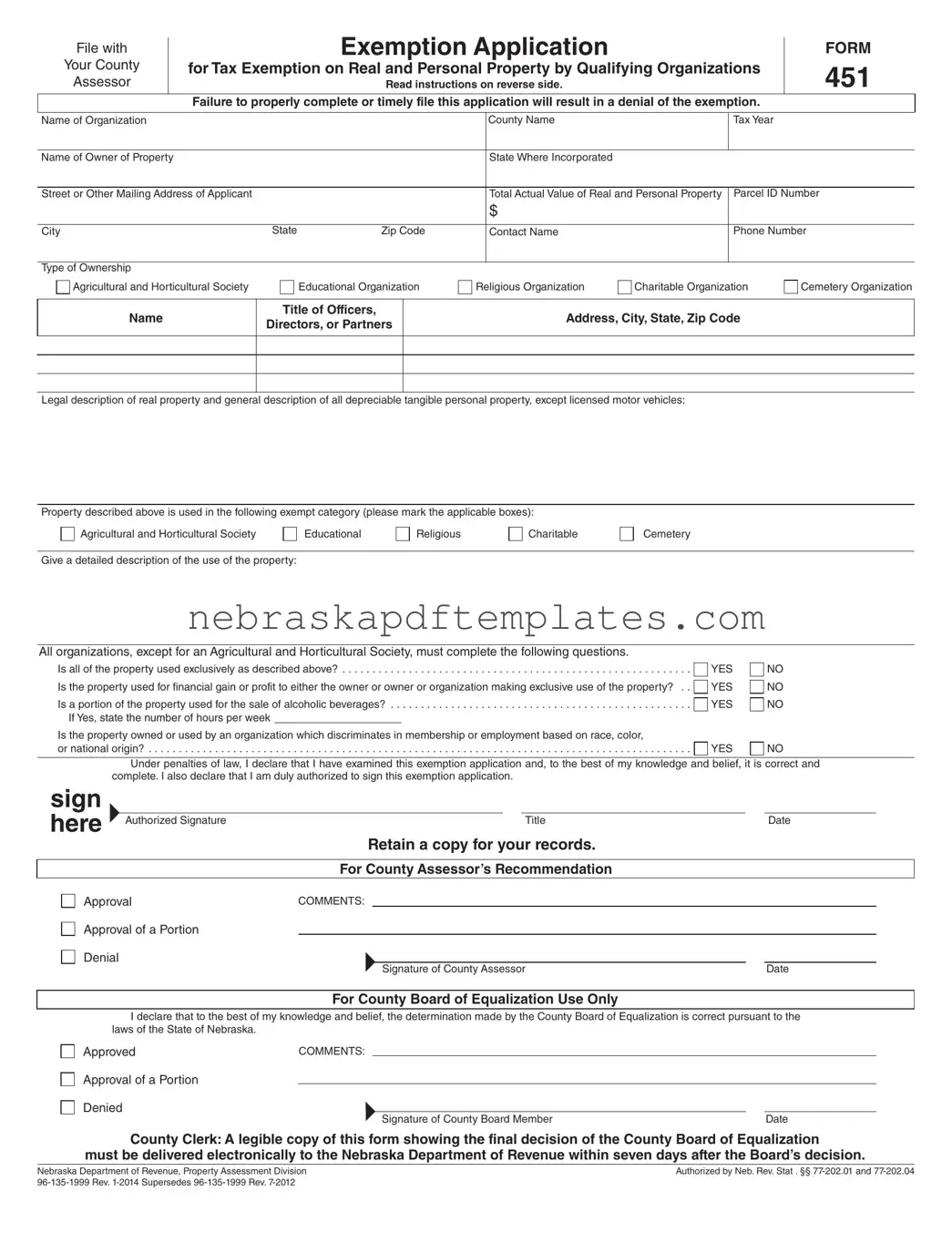

Blank Nebraska 451 PDF Template

The Nebraska 451 form is an application for tax exemption on real and personal property specifically designed for qualifying organizations. This form is crucial for organizations such as educational, religious, and charitable groups seeking to alleviate their property tax burdens. Filling out the form accurately and submitting it on time is essential, as failure to do so may lead to denial of the exemption.

Ready to start your application? Click the button below to fill out the Nebraska 451 form.

Access Editor Here

Blank Nebraska 451 PDF Template

Access Editor Here

Finish your form now

Finalize Nebraska 451 online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Nebraska 451