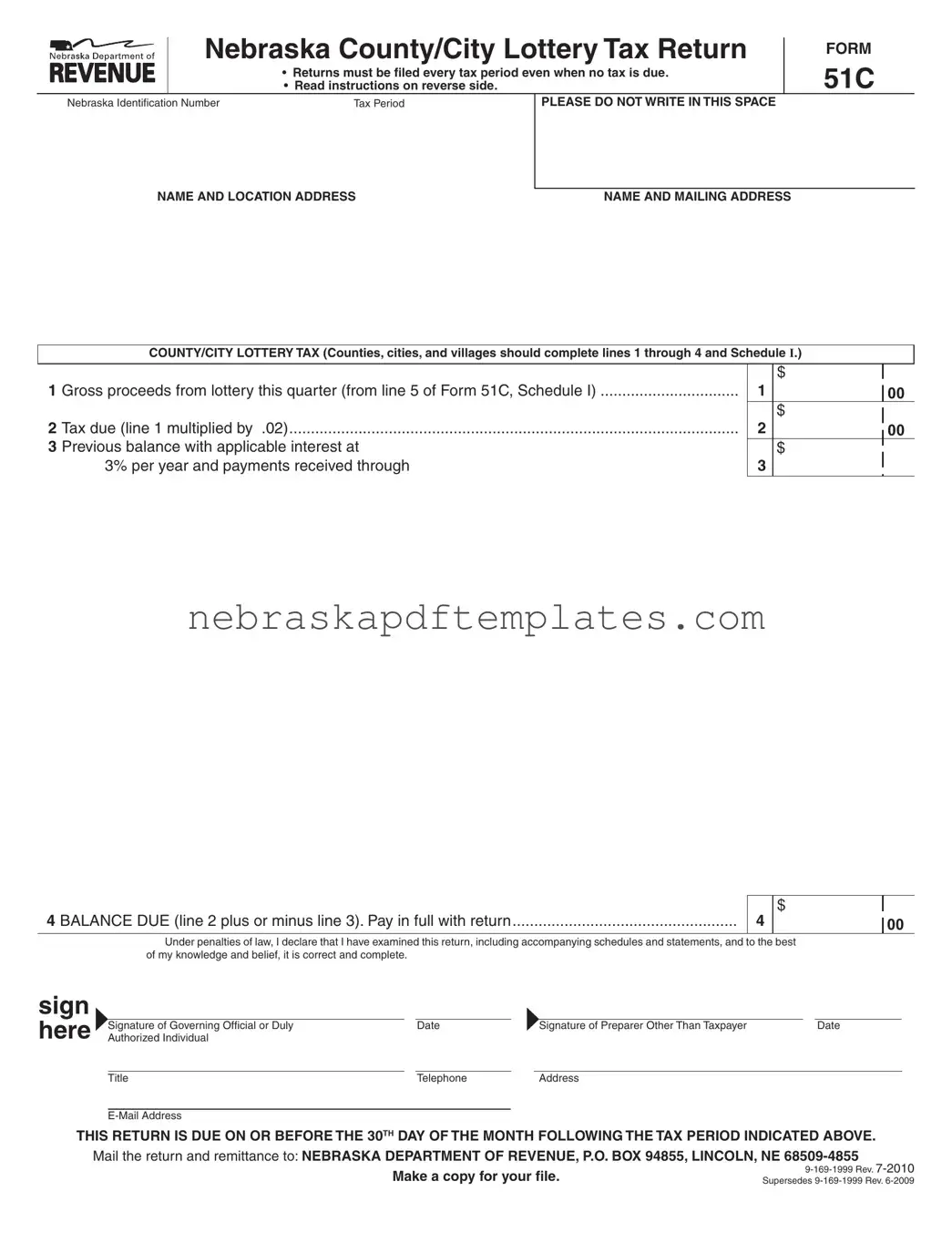

Blank Nebraska 51C PDF Template

The Nebraska 51C form is the official County/City Lottery Tax Return required for all counties, cities, and villages licensed to conduct a lottery in Nebraska. This form must be submitted every tax period, regardless of whether any tax is owed. Understanding the requirements and deadlines associated with this form is crucial for compliance and avoiding penalties.

Ready to fill out the Nebraska 51C form? Click the button below!

Access Editor Here

Blank Nebraska 51C PDF Template

Access Editor Here

Finish your form now

Finalize Nebraska 51C online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Nebraska 51C