Blank Nebraska 6 PDF Template

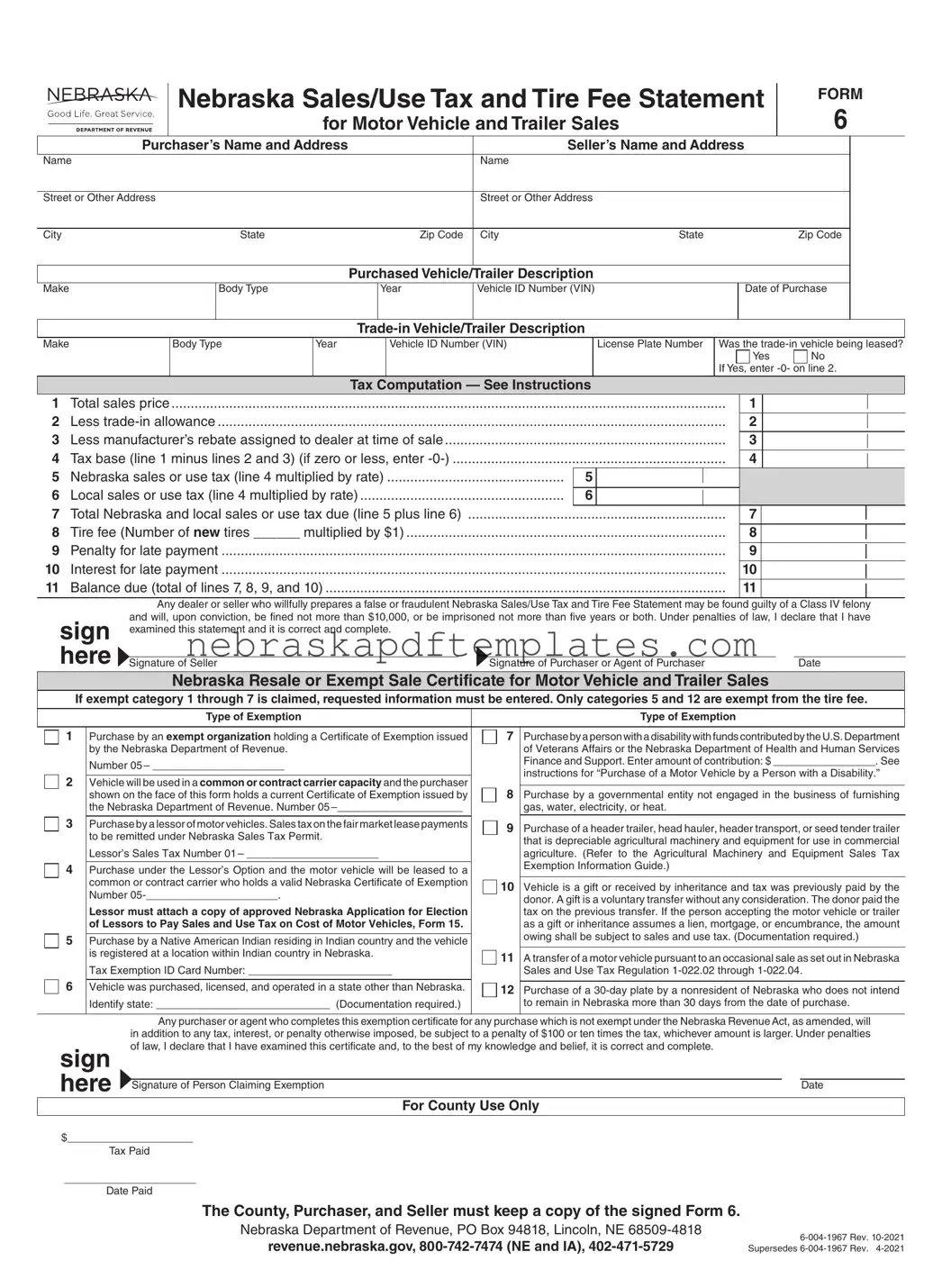

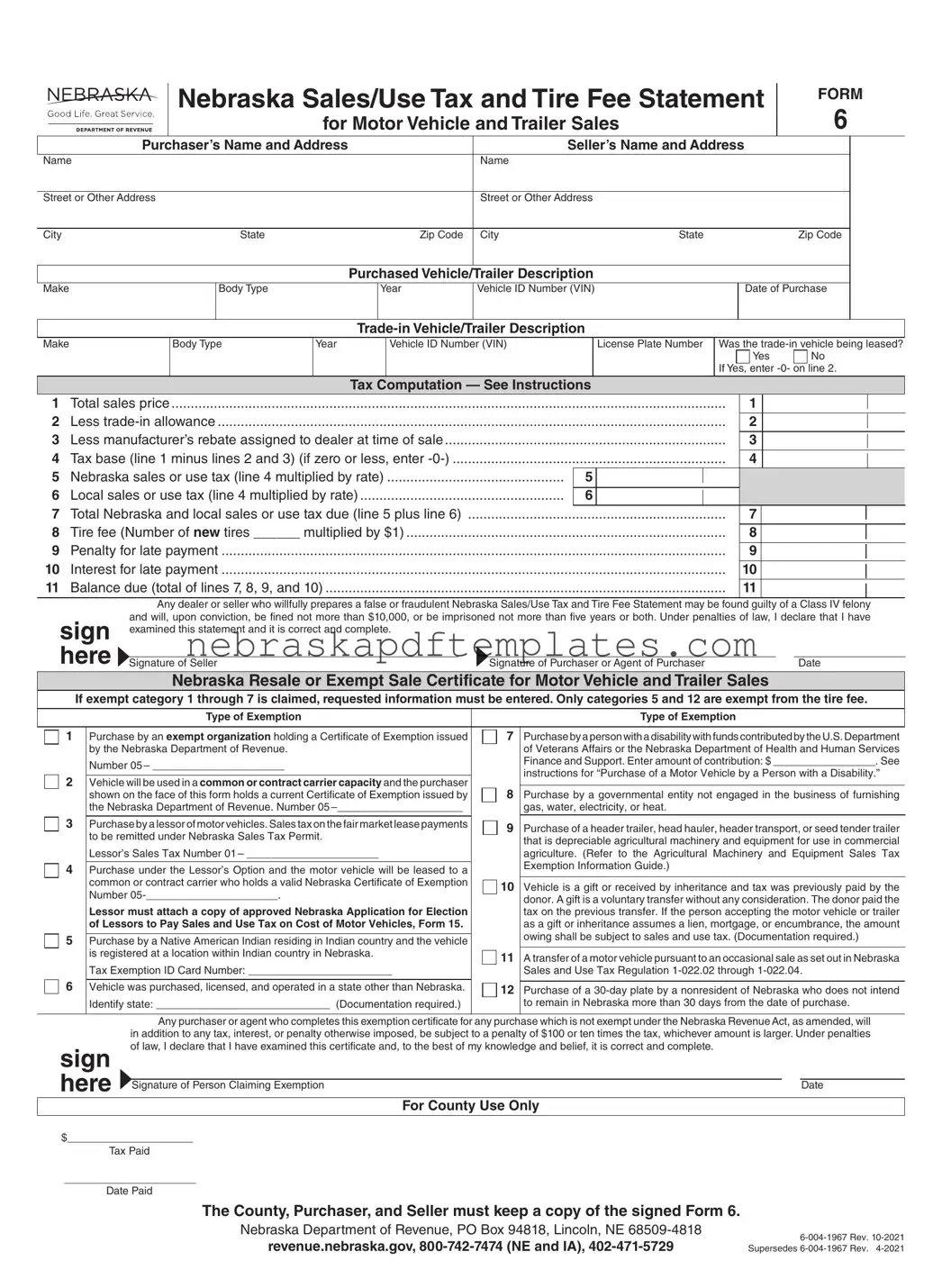

The Nebraska 6 form is a Sales/Use Tax and Tire Fee Statement used for motor vehicle and trailer sales in Nebraska. This form is essential for purchasers to report the sales price, trade-in allowances, and applicable taxes when buying a vehicle or trailer. To ensure compliance and avoid penalties, it is important to fill out the form accurately and submit it within the required timeframe.

To get started on your Nebraska 6 form, please click the button below.

Access Editor Here

Blank Nebraska 6 PDF Template

Access Editor Here

Finish your form now

Finalize Nebraska 6 online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Nebraska 6