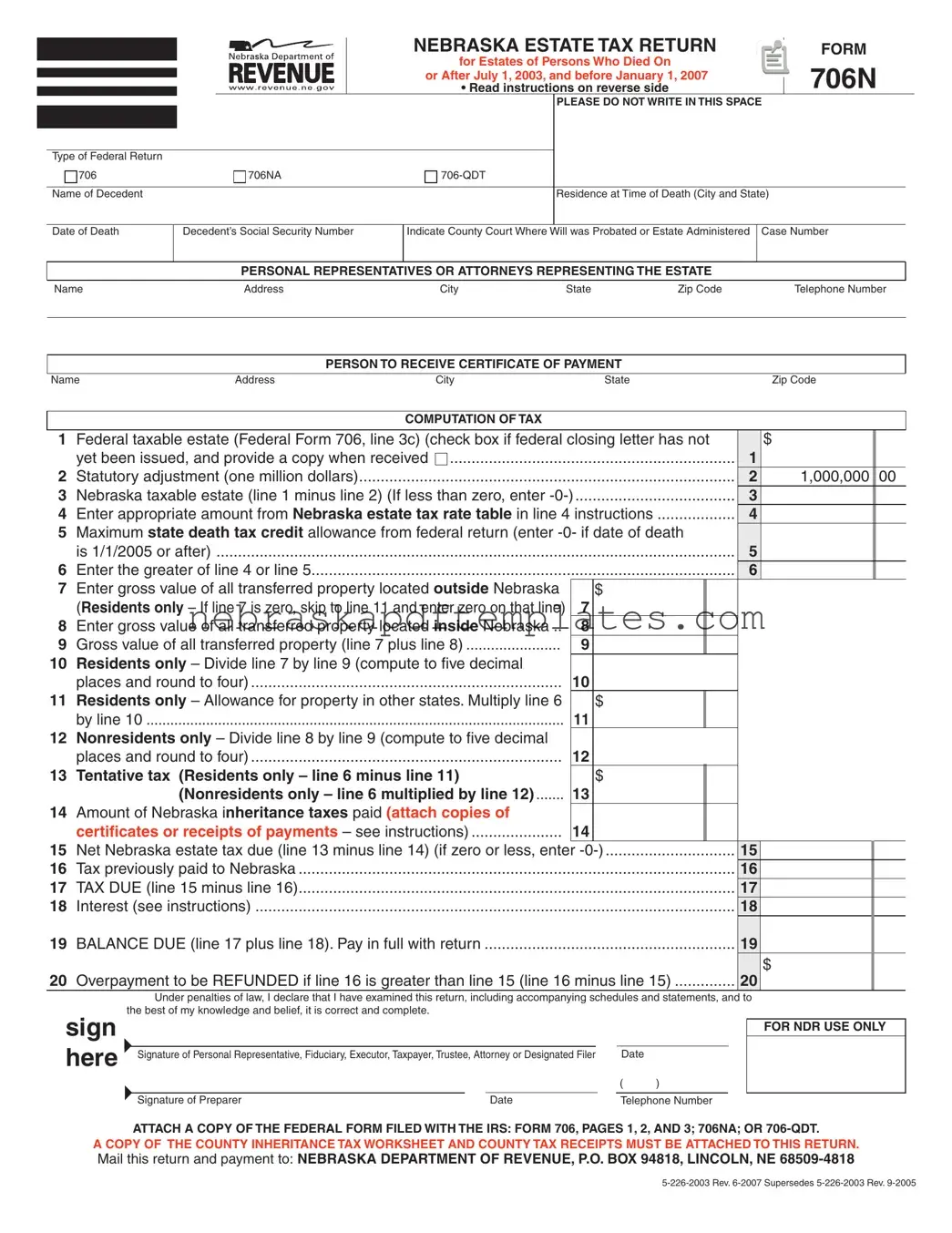

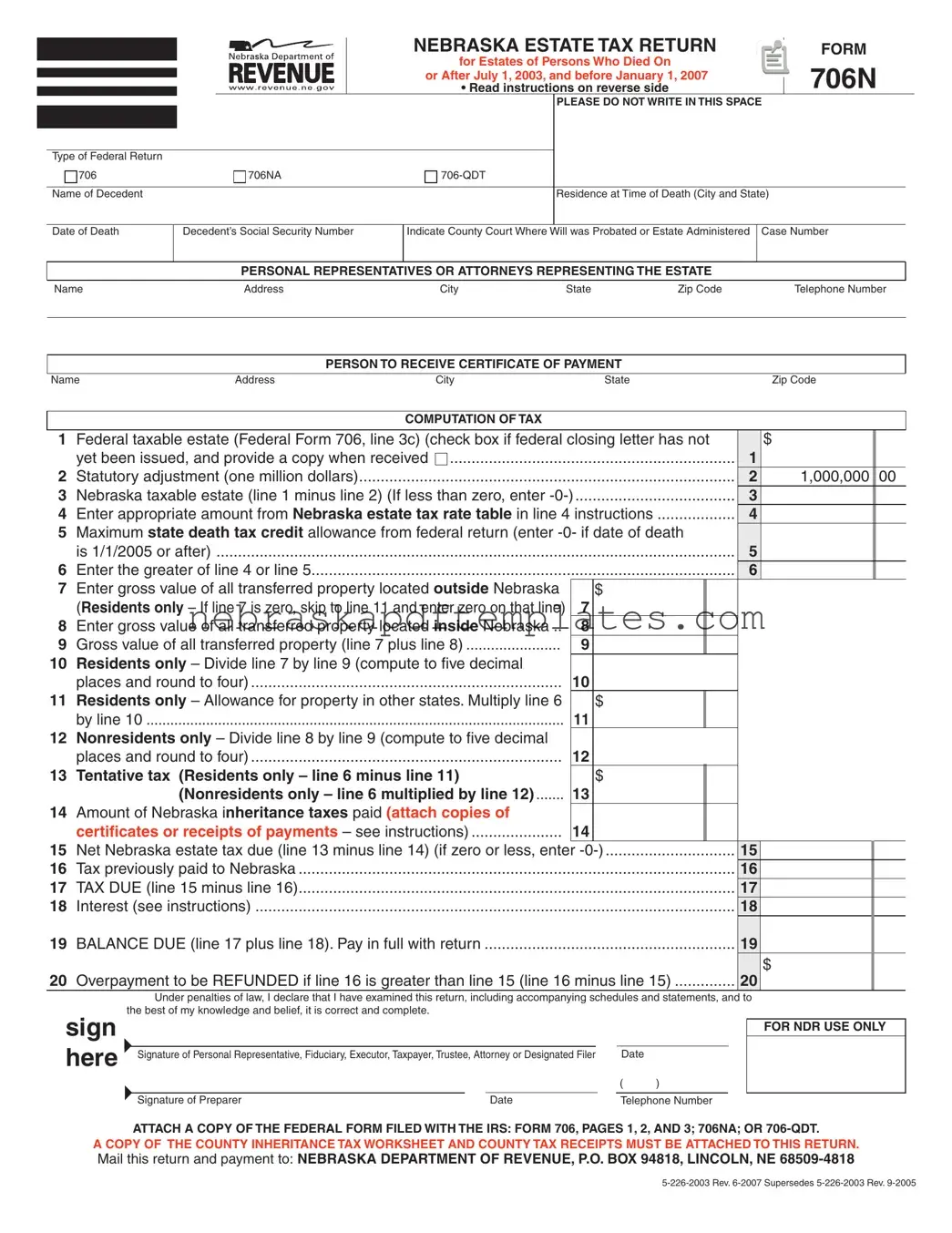

Blank Nebraska 706N PDF Template

The Nebraska 706N form is the official estate tax return required for estates of individuals who passed away between July 1, 2003, and January 1, 2007. This form is essential for determining the Nebraska estate tax due based on the value of the decedent's estate. If you're navigating this process, make sure to fill out the form accurately by clicking the button below.

Access Editor Here

Blank Nebraska 706N PDF Template

Access Editor Here

Finish your form now

Finalize Nebraska 706N online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Nebraska 706N