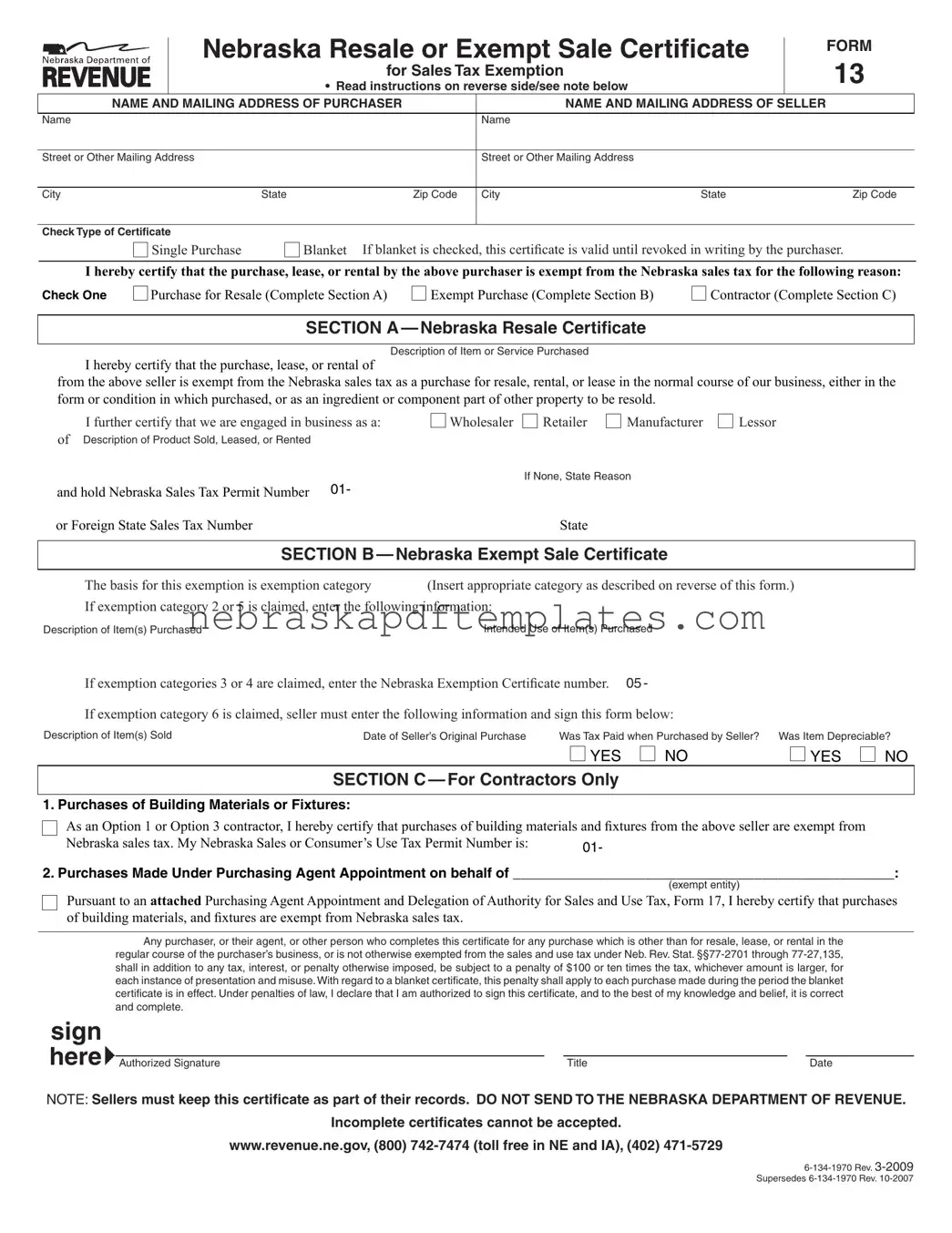

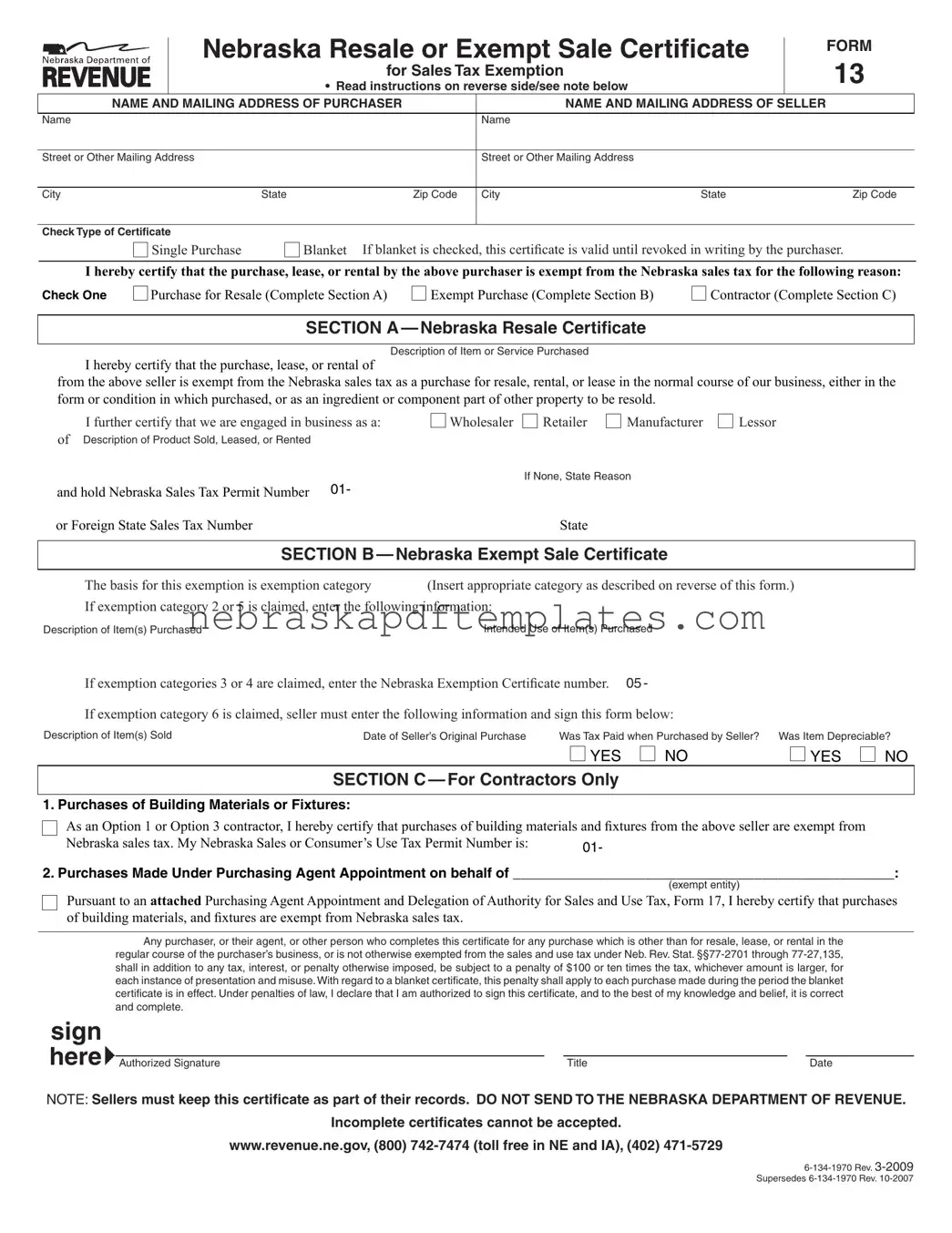

Blank Nebraska Sales Tax PDF Template

The Nebraska Sales Tax Form, specifically Form 13, is a certificate used by purchasers to claim exemptions from sales tax for certain transactions. This form allows businesses and organizations to certify that their purchases are exempt due to resale or specific exemptions outlined by Nebraska law. To ensure compliance and proper use, it is essential to fill out this form accurately.

Ready to complete the Nebraska Sales Tax Form? Click the button below to get started.

Access Editor Here

Blank Nebraska Sales Tax PDF Template

Access Editor Here

Finish your form now

Finalize Nebraska Sales Tax online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Nebraska Sales Tax