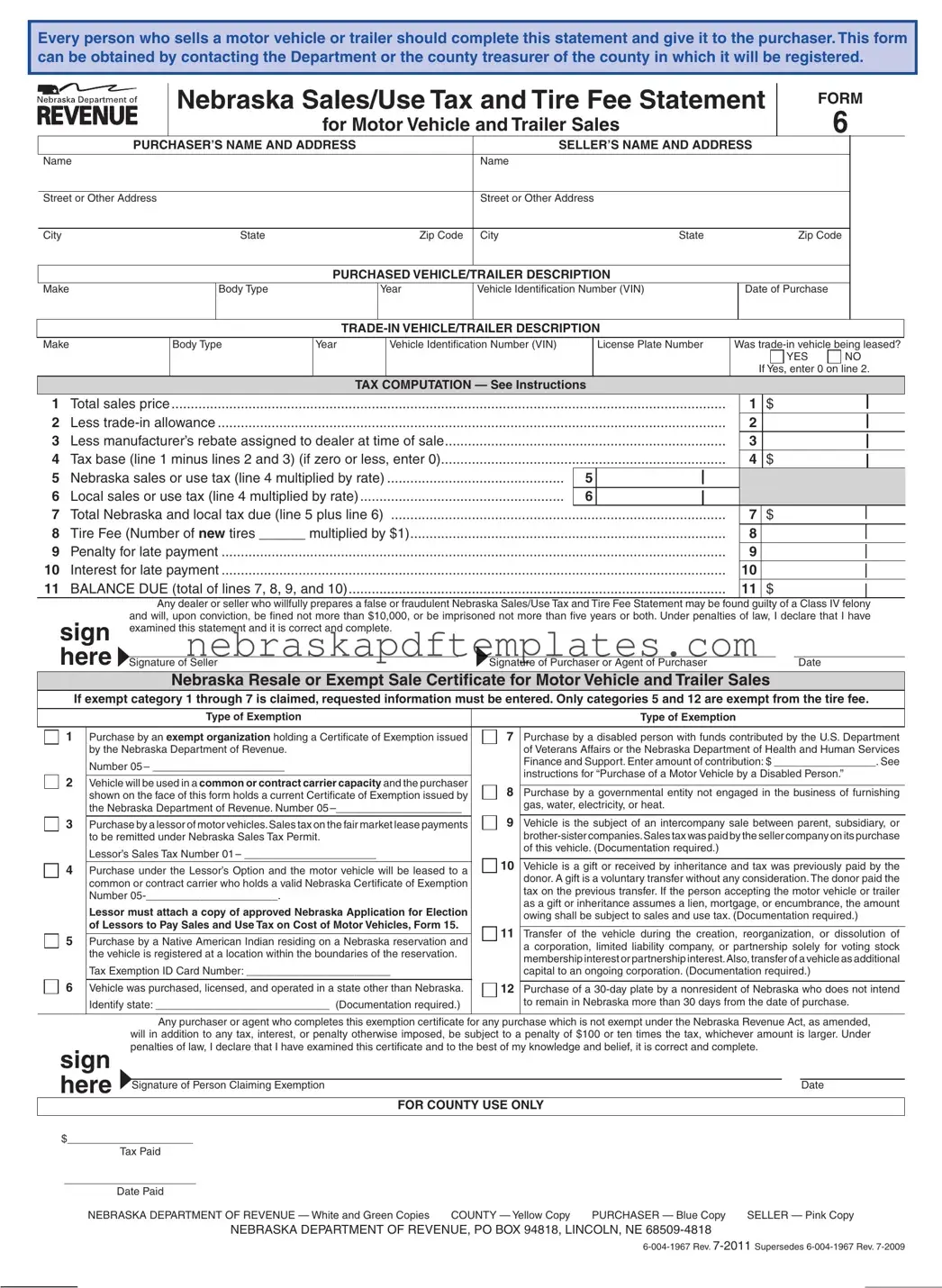

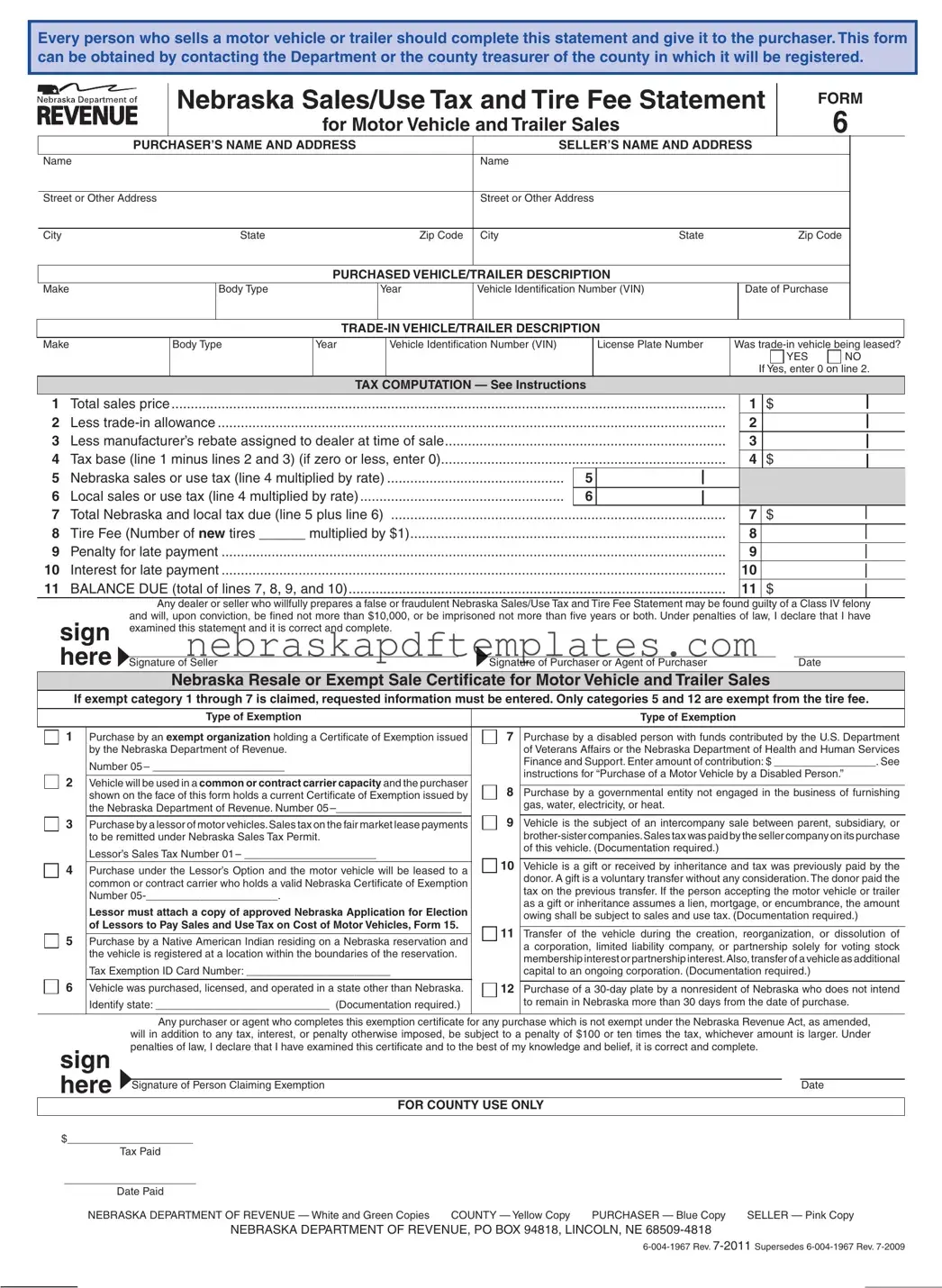

The Nebraska Sales Tax Statement form is required for every sale of a motor vehicle or trailer in Nebraska. Sellers must complete this form and provide it to the purchaser. It serves as a record of the transaction and helps ensure that the appropriate sales and use taxes are calculated and paid. The form can be obtained from the Nebraska Department of Revenue or the county treasurer where the vehicle will be registered.

How do I calculate the sales tax due on a vehicle purchase?

To calculate the sales tax due, follow these steps:

-

Start with the total sales price of the vehicle.

-

Subtract any trade-in allowance for a vehicle being traded in.

-

If applicable, subtract any manufacturer’s rebate assigned to the dealer at the time of sale.

-

The result is your tax base. If this number is zero or negative, enter zero.

-

Multiply the tax base by the Nebraska sales or use tax rate to find the state tax due.

-

Additionally, multiply the tax base by the local sales or use tax rate to find the local tax due.

-

Add the state and local tax amounts together for the total tax due.

Remember to include a tire fee if applicable, which is calculated based on the number of new tires purchased.

What happens if I do not pay the sales tax and tire fee on time?

If the total taxes and tire fee are not paid within 30 days of the purchase date, penalties and interest will be assessed. The county treasurer or designated official will collect these amounts at the statutory rate. It is crucial to pay on time to avoid additional costs. If the due date falls on a weekend or holiday, payment can be made on the next business day without incurring penalties.

Are there any exemptions to the sales tax for vehicle purchases?

Yes, certain exemptions apply to vehicle purchases in Nebraska. For instance, purchases made by exempt organizations or disabled persons with funds from specific government departments may qualify for exemptions. Additionally, vehicles used in specific capacities, such as common carriers, may also be exempt. To claim an exemption, the appropriate section of the Nebraska Resale or Exempt Sale Certificate must be completed, and supporting documentation should be provided. If documentation is insufficient, the tax may still be collected at the time of registration.