What is a Nebraska Promissory Note?

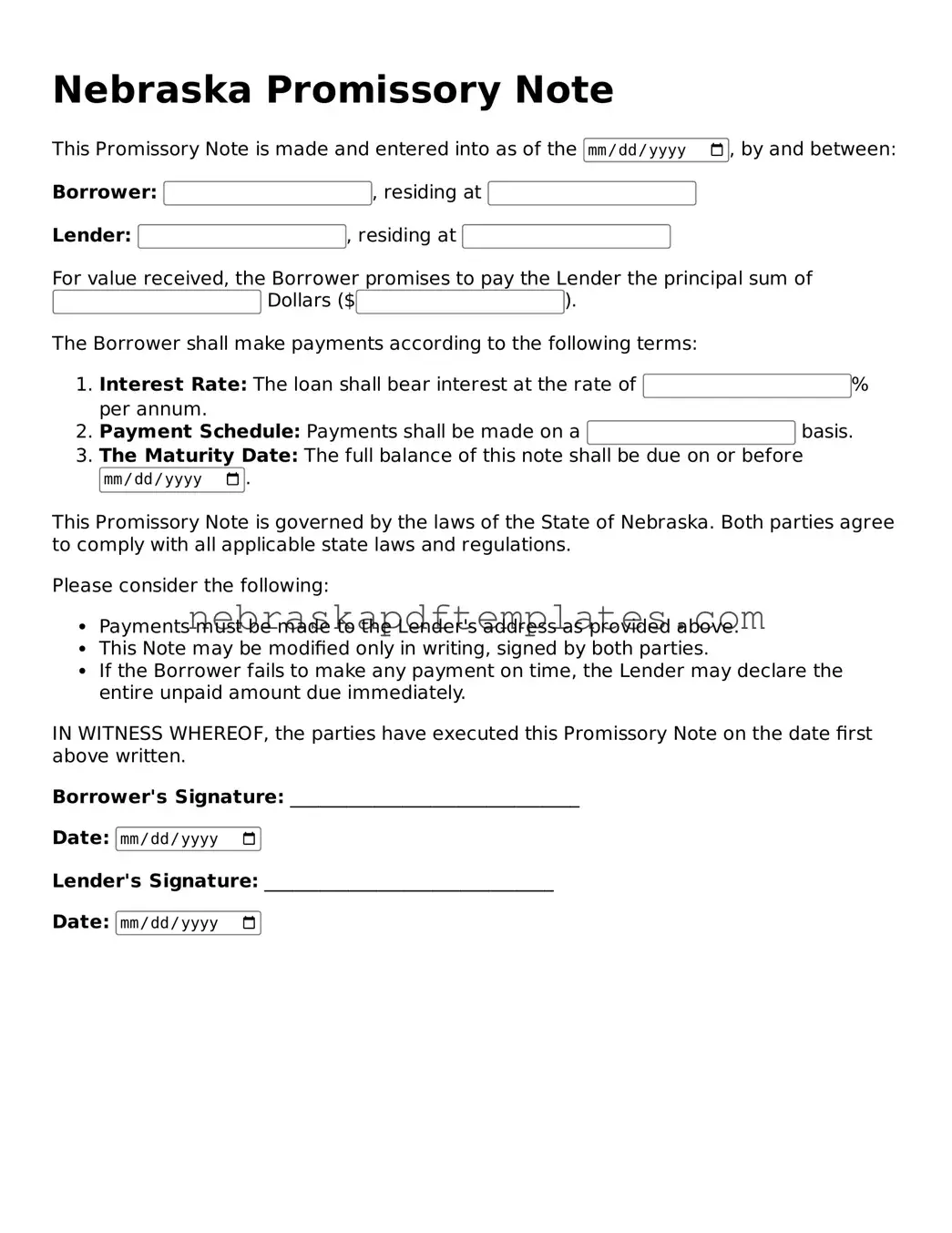

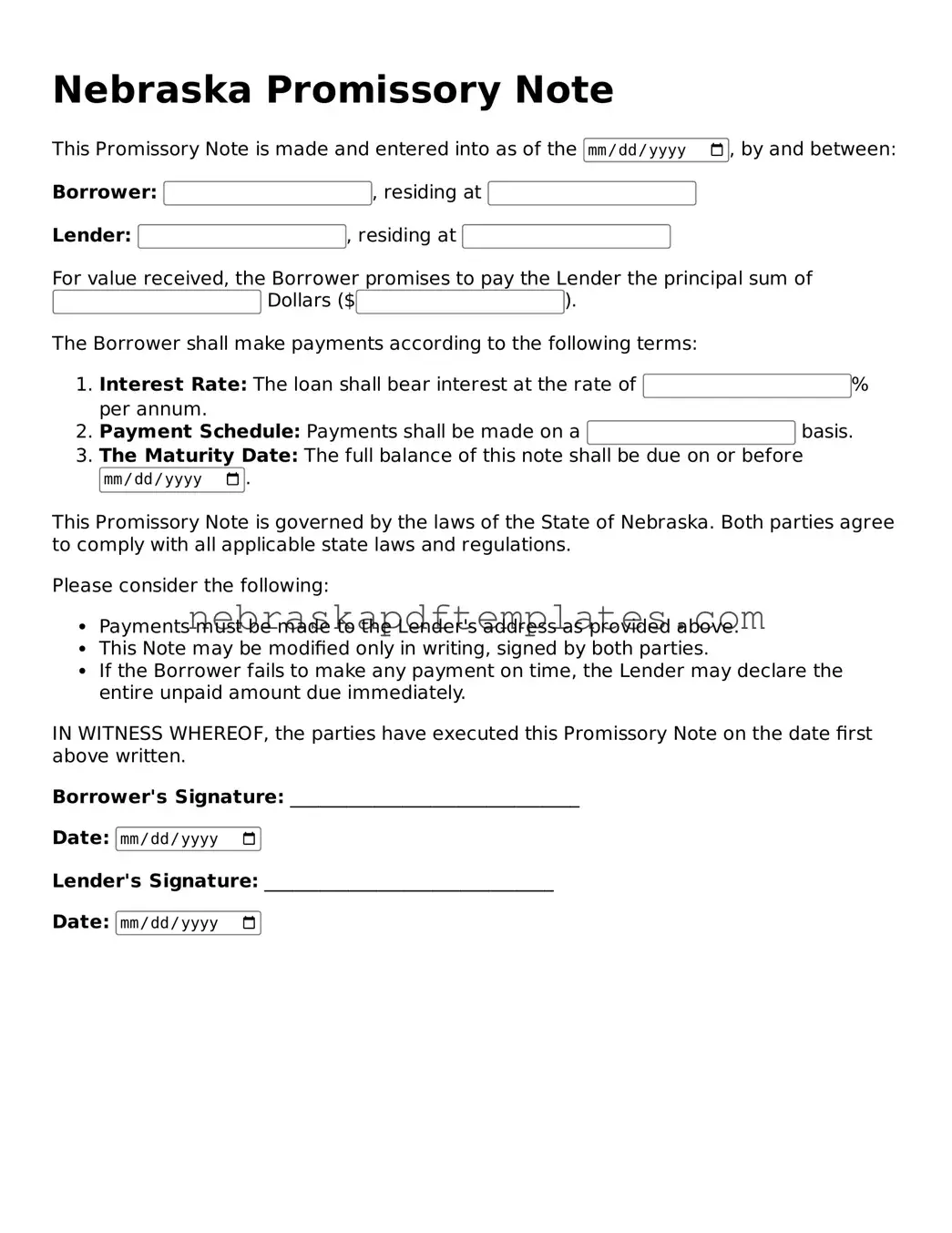

A Nebraska Promissory Note is a legal document that outlines a borrower's promise to repay a specific amount of money to a lender under agreed-upon terms. This note serves as evidence of the debt and details important information such as the loan amount, interest rate, repayment schedule, and any penalties for late payments. It is a crucial tool for both parties, ensuring clarity and protection in the lending process.

What are the key components of a Nebraska Promissory Note?

Several essential elements must be included in a Nebraska Promissory Note to ensure its validity:

-

Parties Involved:

Clearly identify the borrower and lender, including their legal names and addresses.

-

Loan Amount:

Specify the total amount being borrowed.

-

Interest Rate:

State the interest rate, whether it is fixed or variable.

-

Repayment Terms:

Outline the repayment schedule, including due dates and the total duration of the loan.

-

Signatures:

Both parties must sign the document to make it legally binding.

Is a Nebraska Promissory Note legally binding?

Yes, a Nebraska Promissory Note is a legally binding document once it is properly executed. This means that both the borrower and lender have signed it, and it includes all necessary components. If either party fails to adhere to the terms outlined in the note, the other party may have the right to take legal action to enforce the agreement or recover the owed amount.

Can a Nebraska Promissory Note be modified after it is signed?

Yes, a Nebraska Promissory Note can be modified after it has been signed, but both parties must agree to the changes. This is typically done through a written amendment that clearly outlines the new terms. It is important to ensure that both parties sign this amendment to maintain its enforceability.

What happens if the borrower defaults on the Promissory Note?

If the borrower defaults, meaning they fail to make payments as agreed, the lender has several options. They may choose to:

-

Contact the borrower to discuss the situation and possibly renegotiate the terms.

-

Charge late fees as outlined in the note.

-

Pursue legal action to recover the owed amount, which may involve filing a lawsuit.

It's advisable for both parties to communicate openly to find a resolution before escalating to legal measures.