What is a Quitclaim Deed in Nebraska?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another. In Nebraska, this type of deed allows the grantor (the person transferring the property) to relinquish any claim they have to the property without guaranteeing that they have clear title. It is often used in situations where property is transferred between family members or in divorce settlements.

How do I complete a Quitclaim Deed in Nebraska?

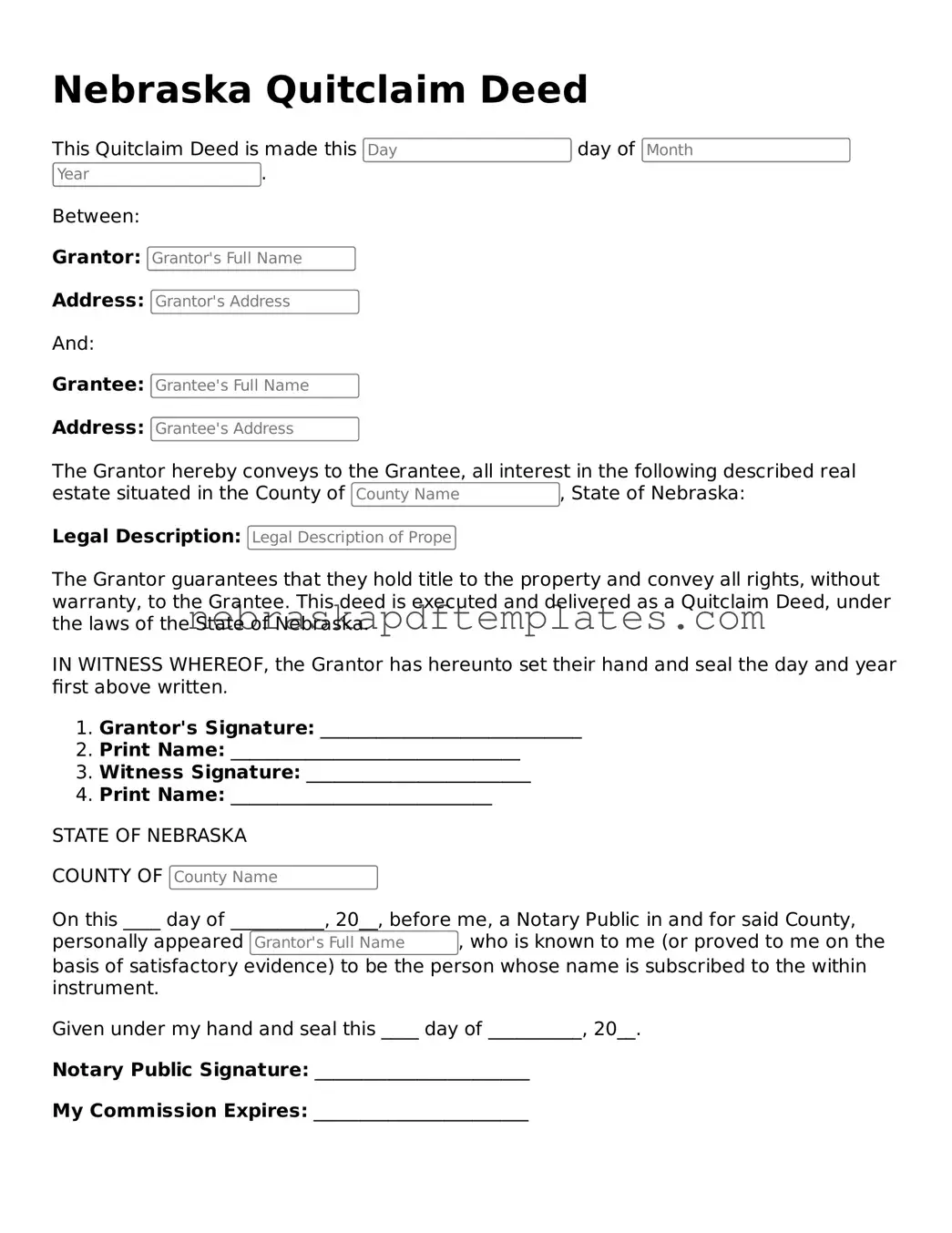

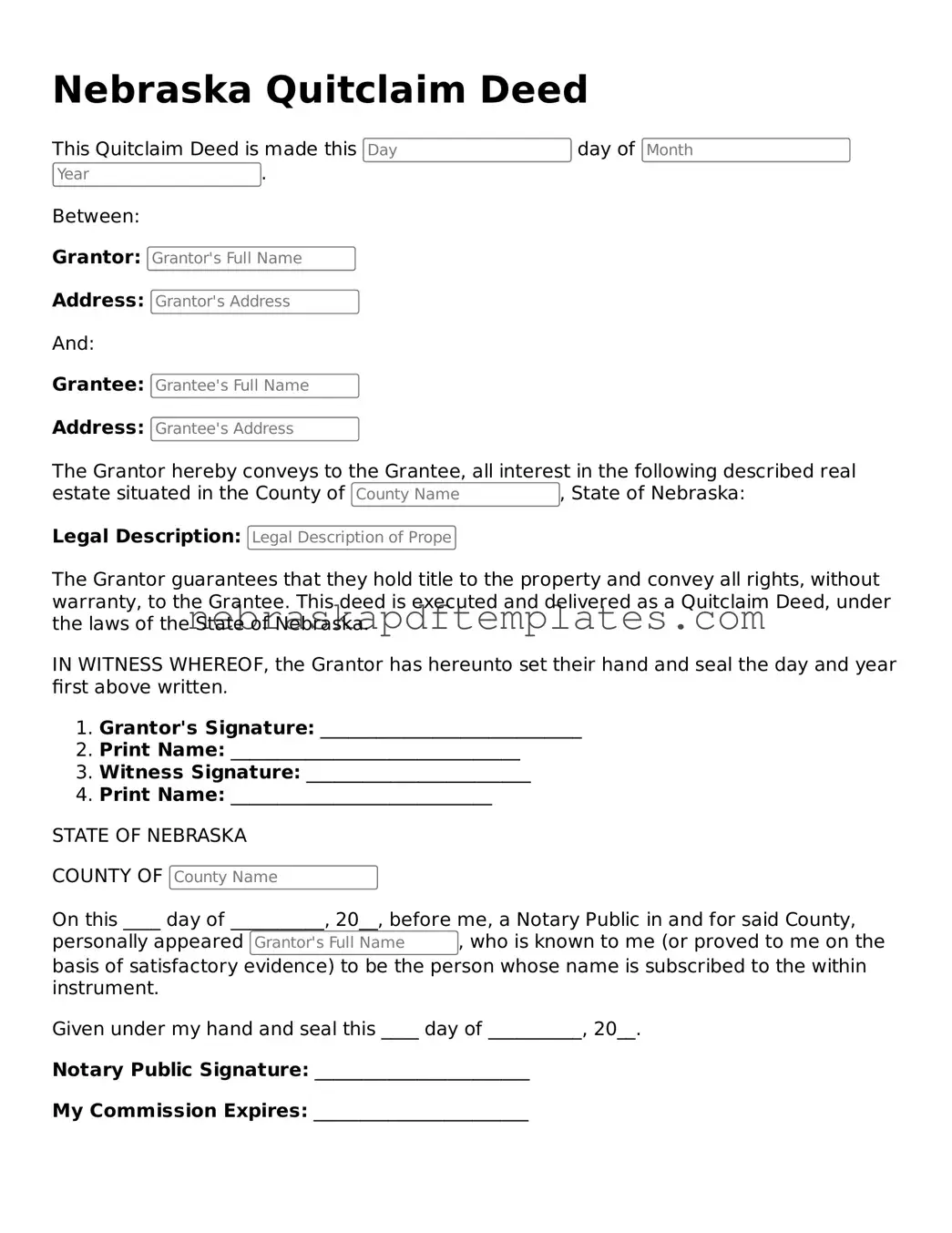

To complete a Quitclaim Deed in Nebraska, follow these steps:

-

Obtain a blank Quitclaim Deed form. You can find these forms online or at local legal offices.

-

Fill in the names of the grantor and grantee. Make sure to include their addresses.

-

Provide a legal description of the property. This can usually be found on the property’s deed or tax records.

-

Sign the document in front of a notary public. The notary will need to witness your signature.

-

File the completed deed with the local county recorder’s office. There may be a small fee for this service.

Do I need a lawyer to prepare a Quitclaim Deed?

No, you do not necessarily need a lawyer to prepare a Quitclaim Deed in Nebraska. Many people choose to fill out the form themselves. However, if you have questions about the property or the implications of the transfer, consulting a lawyer can provide valuable guidance.

What are the benefits of using a Quitclaim Deed?

Using a Quitclaim Deed has several benefits:

-

It is a quick and simple way to transfer property.

-

It can be less expensive than other types of deeds, as it often does not require extensive legal work.

-

It is useful for transferring property between family members or in informal situations.

Are there any risks associated with a Quitclaim Deed?

Yes, there are some risks. A Quitclaim Deed does not guarantee that the grantor has clear title to the property. This means that if there are any liens or claims against the property, the grantee (the person receiving the property) may be responsible for them. It is important to conduct a title search to ensure there are no hidden issues.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such guarantees. It simply transfers whatever interest the grantor has, if any.