Attorney-Verified Small Estate Affidavit Document for Nebraska

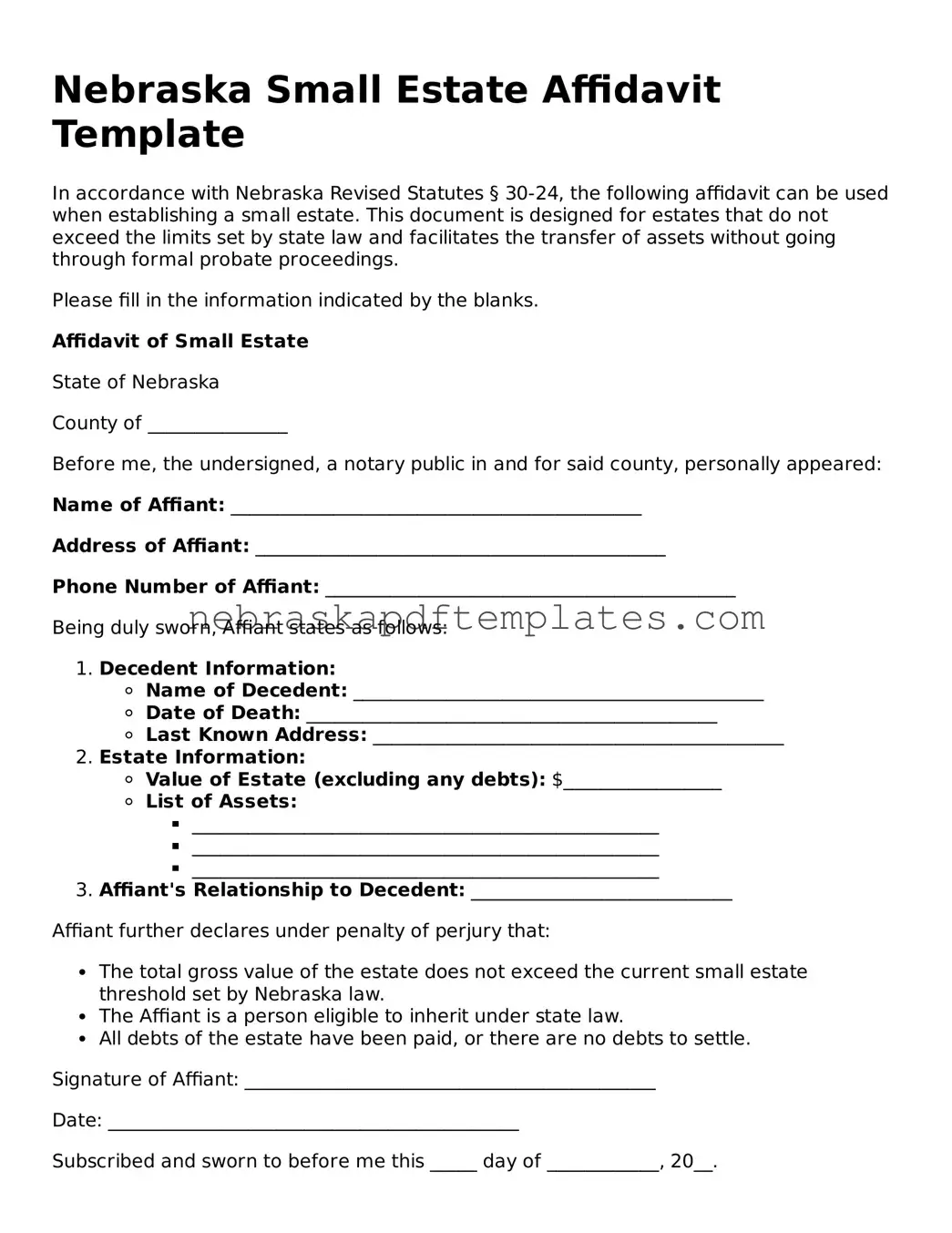

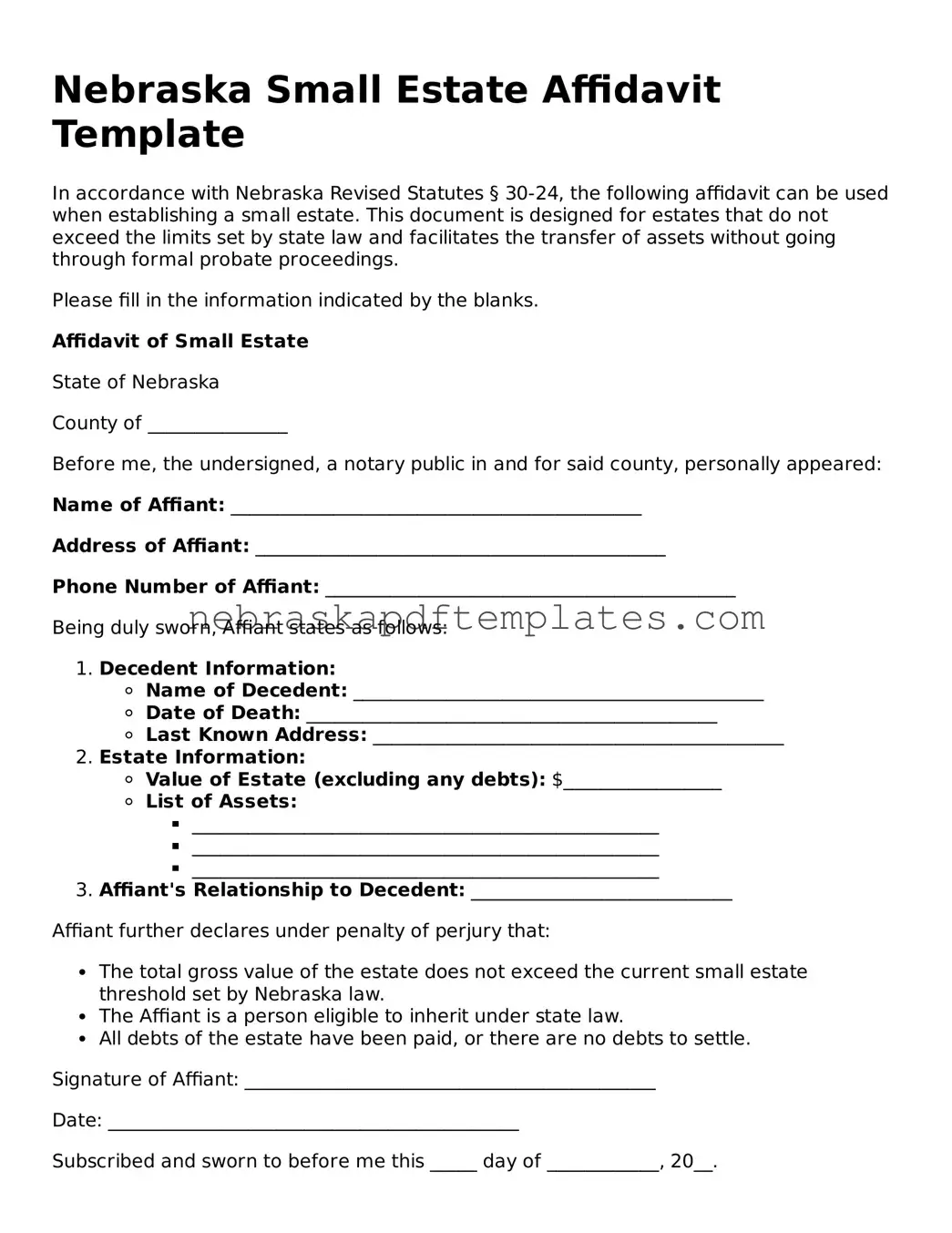

The Nebraska Small Estate Affidavit is a legal document that allows individuals to claim assets of a deceased person without going through the lengthy probate process. This form simplifies the transfer of property for estates that meet certain criteria, making it easier for heirs to access what they are entitled to. If you need to fill out the form, click the button below to get started.

Access Editor Here

Attorney-Verified Small Estate Affidavit Document for Nebraska

Access Editor Here

Finish your form now

Finalize Small Estate Affidavit online — edit, save, and download effortlessly.

Access Editor Here

or

➤ Small Estate Affidavit