What is a Transfer-on-Death Deed in Nebraska?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows property owners in Nebraska to designate a beneficiary who will receive their property upon their death. This deed enables the transfer of real estate without going through probate, simplifying the process for the beneficiary and ensuring a smoother transition of ownership.

Who can use a Transfer-on-Death Deed?

Any individual who owns real estate in Nebraska can use a Transfer-on-Death Deed. This includes homeowners, landowners, and even individuals holding property in joint tenancy. However, it is important to note that the deed must be executed while the owner is alive and competent to make decisions regarding their property.

How do I create a Transfer-on-Death Deed?

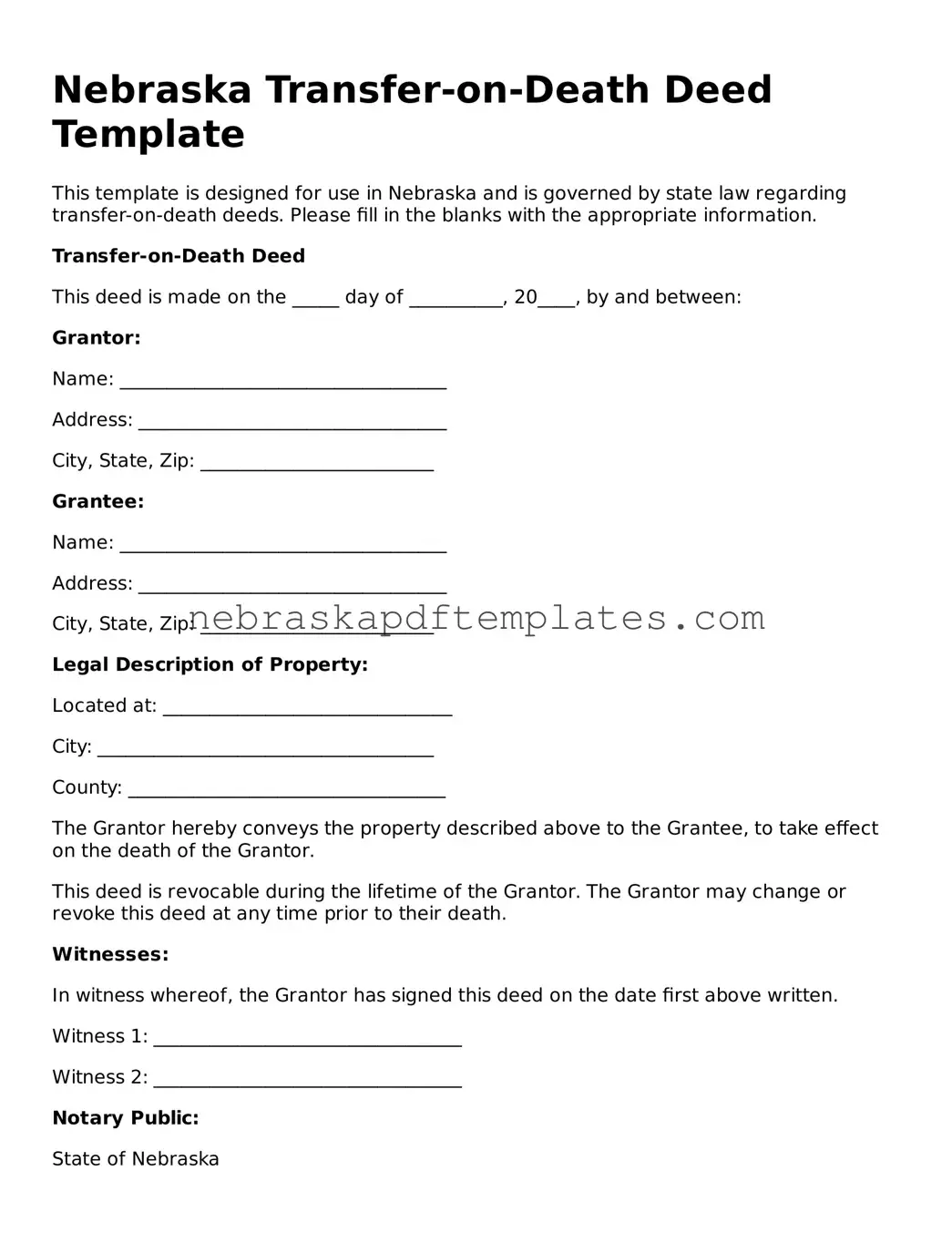

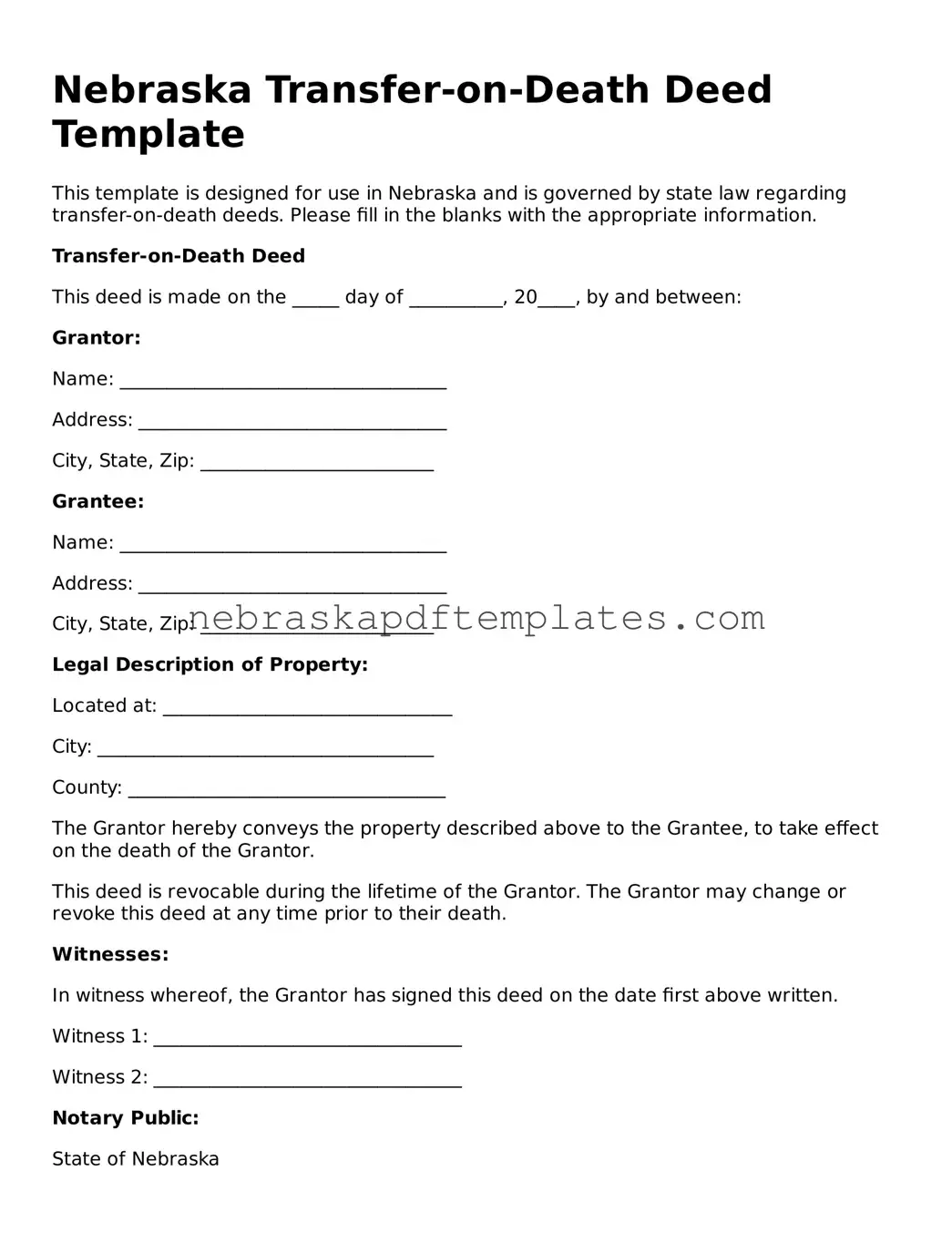

Creating a Transfer-on-Death Deed involves several steps:

-

Obtain the appropriate form for a Transfer-on-Death Deed in Nebraska.

-

Fill out the form with accurate information, including the property description and the beneficiary's details.

-

Sign the deed in the presence of a notary public.

-

Record the signed deed with the county register of deeds in the county where the property is located.

Once recorded, the deed becomes effective upon the owner's death, transferring the property to the designated beneficiary without the need for probate.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you must execute a new deed that either designates a different beneficiary or explicitly revokes the previous deed. It is crucial to record the new or revocation deed with the county register of deeds to ensure that your wishes are honored.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, there are no immediate tax implications for the transfer of property through a Transfer-on-Death Deed. The property is not considered part of the owner's estate for tax purposes at the time of death. However, the beneficiary may be responsible for property taxes and any capital gains taxes if they decide to sell the property in the future. Consulting with a tax professional is advisable to understand the specific implications based on individual circumstances.

What happens if the beneficiary predeceases the owner?

If the designated beneficiary predeceases the owner, the Transfer-on-Death Deed may become ineffective unless alternate beneficiaries are named. It is advisable to include contingent beneficiaries in the deed to ensure that the property will still be transferred according to the owner's wishes. If no alternate beneficiaries are designated, the property will revert to the owner's estate and may be subject to probate.